|

|

Post by nuno on Jun 17, 2019 16:00:08 GMT

... For me this is not a hurdle, it is actuallyan hobby I enjoy ... which you should! BUT: Mintos knows, that people like you will not help them grow faster than the market = prevail. For that, they need to make p2p mainstream and that is exactly what they are trying to do. I don't know where you are from. I'm from Germany and here we have a p2p lending provider called "Auxmoney". They started out more than ten years ago offering lots of loan selection criteria but were not really successful for several years, until at one point they started reducing those options more and more until today all what's left is one nutty overall risk selection slider. Every time they reduced the investors' options they earned a shitstorm in forums like this one, but guess what: now they are growing like hell. No need to like it, but that's the world we're living in  Hello geldregiertdiewelt

I'm from Portugal

What you've said makes sense but bare in mind this 2 things:

- When you start hearing your shoe pollisher talking about investment strategies it is time to run... RUNNN

- Auxmoney must be doing something right for sure but I NEVER HEARD of Auxmoney until now and Mintos is by far far far the biggest platform in Europe, already going into the 3rd billion euro, so they must be doing something right until now, no ?

As I said before I just hope Mintos has enough space for A&I, Autoinvest, and "manual" guys like me

Until now I am very very satisfied with Mintos and to be honest it is something that is truely changing my perspective in life Not many things can change one's perspective during a man's life.

Cheers

|

|

|

|

Post by dbe on Jun 21, 2019 12:58:38 GMT

I second what most have said here. I do not trust rules-based investment engines. Prefer to select new investments on a daily basis even if that is a drag.

|

|

toffeeboy

Member of DD Central

Posts: 538

Likes: 385

|

Post by toffeeboy on Jun 25, 2019 16:47:26 GMT

Guys guys guys ! Please

I said I wont invest in this new " invest & access " tool but lets see if this is cleared up:

- Mintos does the diversification for you - Mintos will only buy "buyback guaranty" loans - Mintos will sell them for you in the secondary market in case you hit the "Cashout" botton

That being said, this things will happens to those of you that will put Money in this tool either because you dont have time or don't care about doing your own investing:

- Mintos will spread your Money also according to their interests, so your 100 euros might end um in 100 diferent loans... manybe some BB Finance: 8,5% maybe some agrocredit 6%, maybe some Hipocredit 6,5% ... So your NAR will be lower than if you hand pick them yourself - Mintos will sell them on the SM but that depends on other people buying the loans.. it is not Mintos that is repurchasing them, it is the secondary market, so unless there is some machinism to make those loans more apealing and sell faster like remaining interest forfeit I dont see how you can get your Money back faster than a normal SM sale

So if you are a guy that is affraid of doing some investment mistake like buying a no buyback loan or a 100 month loan by accident or if you really dont have time and dont care if you earn 10.9% NAR instead of 12.1% then I think you should really try this tool and it is safe, easy and practucal.

So guys obviously there is market for this Mintos tool, I just hope Mintos will also keep all the other "conservative" members also happy.

Cheers

PS: Sorry for the typos but I dont have the english translator on...

Just one possible correction, I believe that if you choose to sell then the loan is transferred to another person in auto invest not actually sold on the secondary market. It might be as a second option but I believe it is to another auto investor first of all.

I like the idea and once you have a fully functional product it is the way to go to get the bigger investors in unfortunately it drives those that helped make it what it is out generally as the original investors want more control than what is available. If you review the evolution of Zopa you will see how this works and how it can be successful as well.

|

|

|

|

Post by geldregiertdiewelt on Jun 28, 2019 8:43:27 GMT

fyi: A&I been adjusted today to "12.32 % average interest rate"

|

|

|

|

Post by geldregiertdiewelt on Jul 17, 2019 20:17:29 GMT

...I have dropped a grand in to see how it all works so will withhold my judgement for a short while.

Anything you could share after one month? thx

|

|

|

|

Post by bilko on Jul 18, 2019 6:27:04 GMT

...I have dropped a grand in to see how it all works so will withhold my judgement for a short while.

Anything you could share after one month? thx Seconded. I'm particularly interested in what % of the loans have gone late.

|

|

toffeeboy

Member of DD Central

Posts: 538

Likes: 385

|

Post by toffeeboy on Jul 18, 2019 10:25:09 GMT

Anything you could share after one month? thx Seconded. I'm particularly interested in what % of the loans have gone late. so far the stats I get are:

Average interest rate is 12.67% Average term is 24 months 12 days Currently 14.16% of my investment is late or in grace period

Maybe it is because have an auto invest on as well but my total invested constantly sits below the portfolio target so some money that comes back is being lent through auto invest where as I expected funds to go to invest and access first so it was kept at my portfolio limit and any excess invested via auto invest. Never big amounts just usually around €40 short.

|

|

benaj

Member of DD Central

N/A

Posts: 5,591

Likes: 1,735

|

Post by benaj on Jul 18, 2019 10:44:05 GMT

Seconded. I'm particularly interested in what % of the loans have gone late. so far the stats I get are:

Average interest rate is 12.67% Average term is 24 months 12 days Currently 14.16% of my investment is late or in grace period

Maybe it is because have an auto invest on as well but my total invested constantly sits below the portfolio target so some money that comes back is being lent through auto invest where as I expected funds to go to invest and access first so it was kept at my portfolio limit and any excess invested via auto invest. Never big amounts just usually around €40 short.

It seems 14.16% late is not too bad considering it's Mintos, but time will tell a better story if the holding is longer than 90 days, still early days to judge.

|

|

|

|

Post by bilko on Jul 18, 2019 10:55:25 GMT

Thanks for the info. I've ditched Bondora G&G and am looking for an alternative with (almost) instant liquidity. I & A looks promising.

|

|

|

|

Post by geldregiertdiewelt on Jul 21, 2019 17:28:42 GMT

|

|

|

|

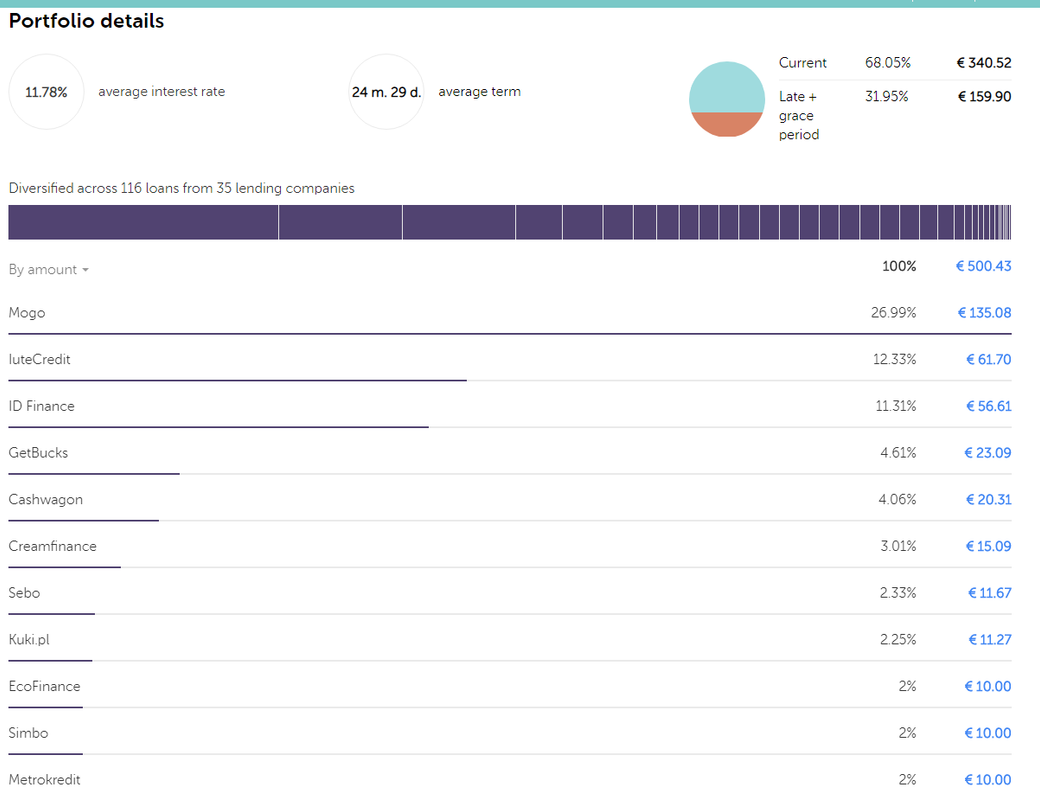

Post by dutchman on Aug 7, 2019 14:35:17 GMT

i only use buyback loans, and my own stats, normally 25% is not current (so all other variations, from grace to 60days late)

for the new 'invest & access' that percentage is 32% (as test i also set a small amount there to see what happened)

also 26% is invested in mogo.

could be because of rating or mixed interest owners(?)

|

|

|

|

Post by dutchman on Aug 7, 2019 14:40:27 GMT

here a screenshot.   |

|

benaj

Member of DD Central

N/A

Posts: 5,591

Likes: 1,735

|

Post by benaj on Aug 23, 2019 8:53:11 GMT

I&A rate is dropping fast. Latest rate is just above 10%.

|

|

|

|

Post by jrgndk on Aug 23, 2019 10:24:38 GMT

Any particular reason why this is happening?

|

|

|

|

Post by hugoncosta on Aug 23, 2019 12:24:21 GMT

Any particular reason why this is happening? I believe older members have said that after the vacation credit in July/August, it dies down a lot. I think the fact that the Eurozone's rates are pushing into negative territory is also helping, how can we be making 16% when deposit rates are below 0?

|

|