benaj

Member of DD Central

N/A

Posts: 5,591

Likes: 1,735

|

Post by benaj on Jan 21, 2020 18:42:51 GMT

Hi benaj 1. It is completely fee-free to sell loans within the Flexible product. Lending Works also covers any interest rate shortfall. 2. Yields are calculated over the lifetime of the loans. Therefore future interest rates on some loans can be lower than the overall expected yield (since a substantial portion of the overall interest may have already been received) and it is this which drives the discount when selling to new investors expecting 4%/5.4% on new loans. The delta is higher currently than it will be going forward due to the one-off transition to the new Shield model. In the future, rates will be adjusted by small increments as necessary throughout the full life of each cohort, rather than retrospectively against prior cohorts. Hope this helps. Hi Matthew Am not sure this was made clear in November. Would many people have been better off selling out fee free, at less of a discount, and then reinvesting sometime in the future if they wanted to? One of the FCA guiding principles for platforms is Communications with clients. A firm must pay due regard to the information needs of its clients, and communicate information to them in a way which is clear, fair and not misleading.

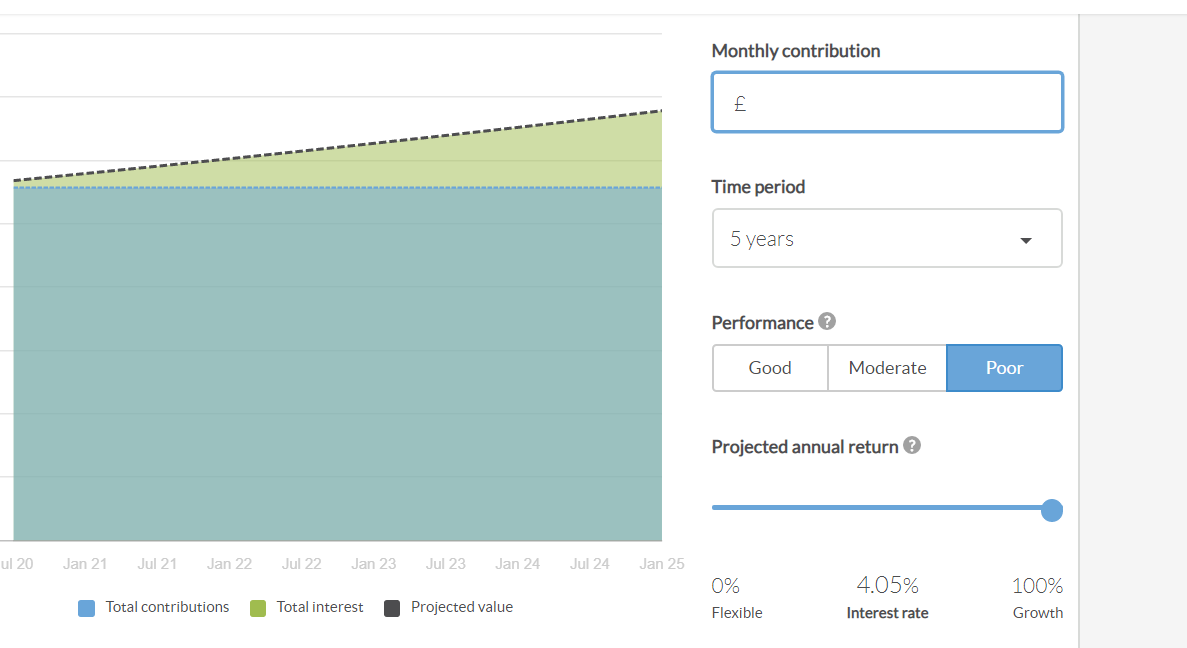

Hi Matthew , thank you for clarification. Could you please also clarify the accrued interest when accessing fund in the Growth product and more about the delta? p2pindependentforum.com/post/341400Do investors receive accrued interest when selling loans in the Growth product? The average 4.3% interest shortfall is BIG, if it is already included the accrued interest. Could it be a mistake some investors did not receive accrued interest when selling loans in the Growth and resulted an average fee of 4.3%? Could you please also explain further why the projected annual return portfolio in the poor scenario is 4.05% while the current Growth return is 5.4% and yet the average interest shortfall could be as big as 4.3%?

|

|

IFISAcava

Member of DD Central

Posts: 3,692

Likes: 3,018

|

Post by IFISAcava on Jan 22, 2020 0:23:48 GMT

Seems to me that what may be happening is that the cut in rates from 6.5% to 5.4% is averaged across the lifespan of the loan. Since a 5 year loan will already have paid months/years at 6.5%, and that the higher rates will have been paid on larger sums of money remaining in each loan, the mathematics means that to make the average across the loan's lifespan end up at 5.4% the loan is now earning only 1 or 2%. So when you sell it the interest loss is 4% vs the new loan rate of 5.4% from the outset. Existing loans can't actually be earning 5.4% otherwise there'd be no interest reduction to be applied when you try and sell.

But it isn't clear really.

Although LW do say this which would cover the above scenario (my bold):

"Expected returns are calculated over the full life of each loan, assuming loans are held to maturity. The actual rate of return receivable may vary throughout the life of the loan, dependent upon the interest rate adjustment required to ensure the Shield remains sufficiently funded."

|

|

IFISAcava

Member of DD Central

Posts: 3,692

Likes: 3,018

|

Post by IFISAcava on Jan 22, 2020 0:27:13 GMT

I think I will rebase the XIRR and see what it is - I predict very low for the foreseeable.

|

|

benaj

Member of DD Central

N/A

Posts: 5,591

Likes: 1,735

|

Post by benaj on Jan 22, 2020 1:29:25 GMT

Seems to me that what may be happening is that the cut in rates from 6.5% to 5.4% is averaged across the lifespan of the loan. Since a 5 year loan will already have paid months/years at 6.5%, and that the higher rates will have been paid on larger sums of money remaining in each loan, the mathematics means that to make the average across the loan's lifespan end up at 5.4% the loan is now earning only 1 or 2%. So when you sell it the interest loss is 4% vs the new loan rate of 5.4% from the outset. Existing loans can't actually be earning 5.4% otherwise there'd be no interest reduction to be applied when you try and sell. But it isn't clear really. Although LW do say this which would cover the above scenario (my bold): "Expected returns are calculated over the full life of each loan, assuming loans are held to maturity. The actual rate of return receivable may vary throughout the life of the loan, dependent upon the interest rate adjustment required to ensure the Shield remains sufficiently funded." I am not an expert. Checking my loanbook, actual default is only 3.6%, and average LW borrower's APR is over 12.9%, surely sheild (cash + future income) which is 6.26% of outstanding loans can cover investor return of 5.4% right? So where does this 4.3% interest shortfall come in? Looking from the Flexible perspective, Flexible investors do not pay any fee nor Interest shortfall for less 1.4% return of Growth Investor when selling loans.

|

|

IFISAcava

Member of DD Central

Posts: 3,692

Likes: 3,018

|

Post by IFISAcava on Jan 22, 2020 9:24:54 GMT

Seems to me that what may be happening is that the cut in rates from 6.5% to 5.4% is averaged across the lifespan of the loan. Since a 5 year loan will already have paid months/years at 6.5%, and that the higher rates will have been paid on larger sums of money remaining in each loan, the mathematics means that to make the average across the loan's lifespan end up at 5.4% the loan is now earning only 1 or 2%. So when you sell it the interest loss is 4% vs the new loan rate of 5.4% from the outset. Existing loans can't actually be earning 5.4% otherwise there'd be no interest reduction to be applied when you try and sell. But it isn't clear really. Although LW do say this which would cover the above scenario (my bold): "Expected returns are calculated over the full life of each loan, assuming loans are held to maturity. The actual rate of return receivable may vary throughout the life of the loan, dependent upon the interest rate adjustment required to ensure the Shield remains sufficiently funded." I am not an expert. Checking my loanbook, actual default is only 3.6%, and average LW borrower's APR is over 12.9%, surely sheild (cash + future income) which is 6.26% of outstanding loans can cover investor return of 5.4% right? So where does this 4.3% interest shortfall come in? Looking from the Flexible perspective, Flexible investors do not pay any fee nor Interest shortfall for less 1.4% return of Growth Investor when selling loans.Making it a better deal at the moment factoring in liquidity v return

|

|

|

|

Post by befuddled on Jan 22, 2020 13:04:35 GMT

The mistake I made was being swayed by the .5% withdrawal fee, as I was uncertain I would stay invested for the full 5 years.

This is obviously lower than Ratersetter's 1.5% fee which was the alternative I was considering.

I think LW are disingenuous hiding the REAL fee of 5+% in the small print (by virtue of alluded and unexplained complex interest calculations).

The headline fee of .5% is boloney, I was suckered in by this headline, maybe others have too.

My take-home - only invest in the 5 yr product if you are absolutely certain you want to stay the course - otherwise all interest earned will disappear in fees if you sell out early.

|

|

|

|

Post by propman on Jan 22, 2020 14:37:55 GMT

AIUI the discounts on rate are different for each annual loan cohort. As a result, someone who has loans in a cohort that will require far more support from the Shield than was intended at the outset will have a larger discount. This effect will be increased as only the remaining period and principal on the loan will be available to generate sufficient income for the Shield. So if 3% of initial lending is expected to be required, but there is only an estimated 18 months payable on these loans (ie loans expected to last average of 3 years due to amortising principal) then the initial rate (say 6%) will be reduced by 2% (so 4% payable). So shortfall 1.4%, 2.1% (x 1.5 years) interest shortfall due.

|

|

benaj

Member of DD Central

N/A

Posts: 5,591

Likes: 1,735

|

Post by benaj on Jan 22, 2020 14:52:30 GMT

Until Matthew clarifies what’s been changed since December regarding accrued interest when accessing fund in the growth product and the sudden jump in interest shortfall, it's better not to sell loans in as hurry. Currently, interest shortfall can be as low as 0.8% for selling a loan chunk |

|

alanh

Posts: 556

Likes: 560

|

Post by alanh on Jan 22, 2020 16:33:15 GMT

Unless the provision fund runs out in the meantime

|

|

ashtondav

Member of DD Central

Posts: 1,814

Likes: 1,092

|

Post by ashtondav on Jan 22, 2020 17:36:56 GMT

Gulp! Just been quoted nearly £70 to sell £1500. I’ll just withdraw as payments come in.

Shame as LW were a favourite.

|

|

IFISAcava

Member of DD Central

Posts: 3,692

Likes: 3,018

|

Post by IFISAcava on Jan 22, 2020 17:58:52 GMT

Gulp! Just been quoted nearly £70 to sell £1500. I’ll just withdraw as payments come in. Shame as LW were a favourite. You had better change your footnote because we aren't getting 5.4% at the moment, whatever the headline figure says. We've had a hidden haircut.

|

|

|

|

Post by befuddled on Jan 22, 2020 18:43:33 GMT

Gulp! Just been quoted nearly £70 to sell £1500. I’ll just withdraw as payments come in. Shame as LW were a favourite. I considered this - but with all the negative news around on P2P in general was "happy" to take the hit. Not happy that even after taking the hit I can't fully get out. I now have residual cr*p in FC and LW. Ratesetter was a clean exit. Hope to be out of GS at month end - forgoing the bonus, but (hopefully) getting all funds out plus interest I saw an article explaining the tightening up of credit from banks after GFC, and it being no co-incidence that that was the same time P2P started, and essentially, P2P a) picking up the loans banks wouldn't take, and b) individuals (as opposed to institutions) taking the risk... I don't know the truth of the above - but after my experiences with FC, it seemed to fit, and even if not true all the platforms seem to be "creaking at the seems" and we're not even in a down turn yet... Unless you are really 100% committed to staying the full 5 years - you are better off with a FSCA protected long term savings account even if it only pays 1.8%.

|

|

jlend

Member of DD Central

Posts: 1,840

Likes: 1,465

|

Post by jlend on Jan 22, 2020 18:54:57 GMT

Can anyone see these columns when you download your loanbook?

Chunk capital outstanding

Outstanding capital repayments on the loan chunk

Chunk interest remaining

Outstanding interest payments on the loan chunk, assuming loan completes full remaining term

Chunk expected annual rate

Expected annualised rate on the loan chunk

|

|

|

|

Post by captainconfident on Jan 22, 2020 19:08:12 GMT

Unless you are really 100% committed to staying the full 5 years - you are better off with a FSCA protected long term savings account even if it only pays 1.8%. You're forgetting the the danger of inflation if you stick your money into a long term fixed rate bank product. If Brexit goes sour we could see rapid inflation acceleration in 2021.

|

|

|

|

Post by befuddled on Jan 22, 2020 19:59:22 GMT

Unless you are really 100% committed to staying the full 5 years - you are better off with a FSCA protected long term savings account even if it only pays 1.8%. You're forgetting the the danger of inflation if you stick your money into a long term fixed rate bank product. If Brexit goes sour we could see rapid inflation acceleration in 2021. I got out less than I put in. Inflation don't enter into it !

|

|