tallsuk

Member of DD Central

Posts: 143

Likes: 128

|

Post by tallsuk on Dec 19, 2021 11:06:50 GMT

Following the rise in inflation and the first increase in interest rates I would have thought it would have been discussed more here. I am interested to hear what people think the future holds for us.

I think the next 12-18 months is going to be more of the same, inflation rising quickly and interest rates rising slowly but that could well mean we are in a far worse position 2 years from now.

Printing money following the pandemic was a reasonable solution to a serious global problem. However, it is trick that can only be used once in a lifetime. Printing money to bail out banker’s cock ups and then trying to do it again 10 years later is, I believe, going to have serious ramifications.

What does everyone else think? Am I just needlessly panicking?

|

|

keitha

Member of DD Central

2024, hopefully the year I get out of P2P

Posts: 4,587

Likes: 2,623

|

Post by keitha on Dec 19, 2021 11:30:58 GMT

yes

most of the world is in the same situation

|

|

adrianc

Member of DD Central

Posts: 10,014

Likes: 5,142

|

Post by adrianc on Dec 19, 2021 11:41:37 GMT

Bank base rates are still ludicrously, artificially low.  It's only been 0.1% since March 2020. Before that, it'd been 0.75% since 2018. Most of the time since the crash, it was 0.5%, and had only dipped to 0.25% (a record low at the time) for a couple of years after the referendum result. As for inflation... Yes, a 5% blip is high. But not unprecedented.  |

|

james100

Member of DD Central

Posts: 1,086

Likes: 1,288

|

Post by james100 on Dec 19, 2021 12:00:31 GMT

Following the rise in inflation and the first increase in interest rates I would have thought it would have been discussed more here. I am interested to hear what people think the future holds for us. I think the next 12-18 months is going to be more of the same, inflation rising quickly and interest rates rising slowly but that could well mean we are in a far worse position 2 years from now. Printing money following the pandemic was a reasonable solution to a serious global problem. However, it is trick that can only be used once in a lifetime. Printing money to bail out banker’s cock ups and then trying to do it again 10 years later is, I believe, going to have serious ramifications. What does everyone else think? Am I just needlessly panicking? Genuine question here...what are you worried about happening exactly? What does "far worse position" mean to you (or if you're referring to society as a whole and that differs, to them)? The net effect will vary on an individual level depending on their personal balance sheet. So will the alternatives to printing money!

|

|

tallsuk

Member of DD Central

Posts: 143

Likes: 128

|

Post by tallsuk on Dec 19, 2021 12:28:39 GMT

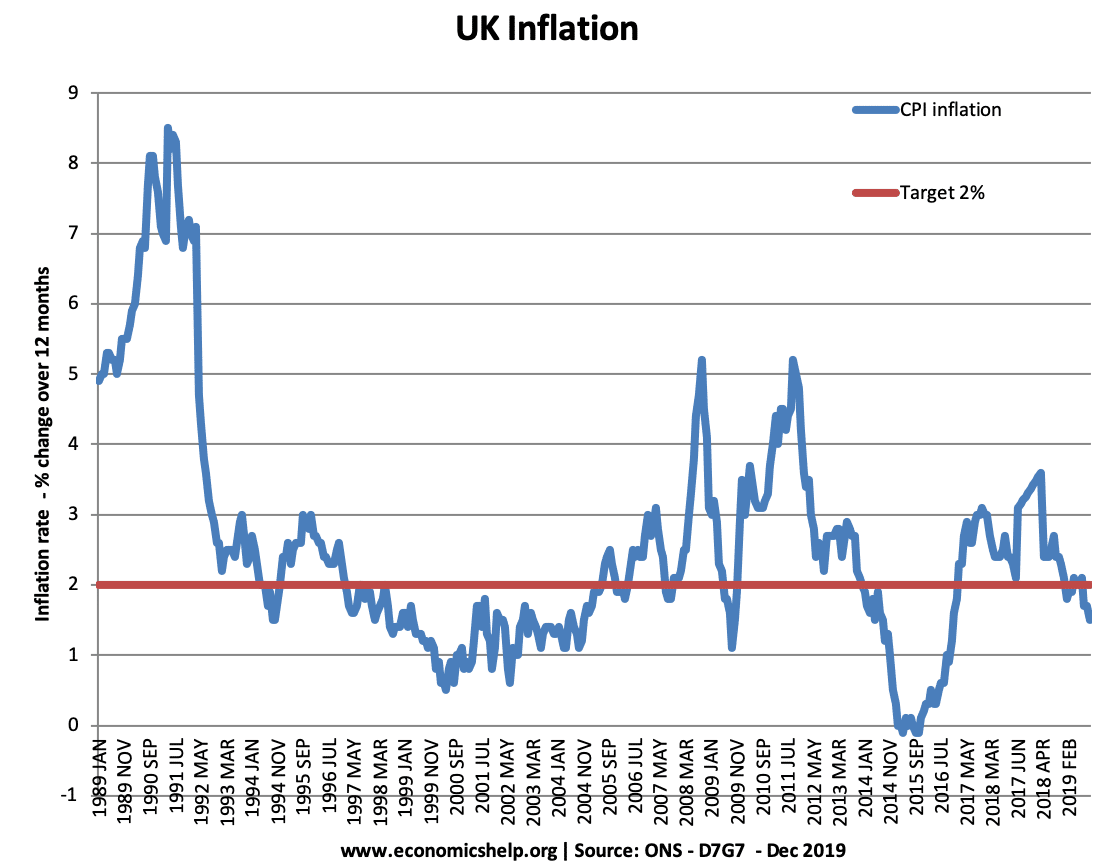

What I am concerned about is that there were only three times in the 20th century when base rates were lower than inflation: WW1, WW2, and the 1970s.  I am too young to remember the 1970s but I can remember 1990 when interests rates jumped to 15%. That hurt everyone. The only way to reduce inflation is by pushing interest rates higher which is why governments around the world are trying to keep inflation at the ideal 2%. Letting inflation run like this is a recipe for disaster. |

|

tallsuk

Member of DD Central

Posts: 143

Likes: 128

|

Post by tallsuk on Dec 19, 2021 12:32:10 GMT

For the longer term view:  |

|

agent69

Member of DD Central

Posts: 6,043

Likes: 4,437

|

Post by agent69 on Dec 19, 2021 13:15:32 GMT

What I am concerned about is that there were only three times in the 20th century when base rates were lower than inflation: WW1, WW2, and the 1970s. <button disabled="" class="c-attachment-insert--linked o-btn--sm">Attachment Deleted</button> I am too young to remember the 1970s but I can remember 1990 when interests rates jumped to 15%. That hurt everyone. The only way to reduce inflation is by pushing interest rates higher which is why governments around the world are trying to keep inflation at the ideal 2%. Letting inflation run like this is a recipe for disaster. Lucky you don't live in Turkey

|

|

keitha

Member of DD Central

2024, hopefully the year I get out of P2P

Posts: 4,587

Likes: 2,623

|

Post by keitha on Dec 19, 2021 13:26:50 GMT

What I am concerned about is that there were only three times in the 20th century when base rates were lower than inflation: WW1, WW2, and the 1970s. <button disabled="" class="c-attachment-insert--linked o-btn--sm">Attachment Deleted</button> I am too young to remember the 1970s but I can remember 1990 when interests rates jumped to 15%. That hurt everyone. The only way to reduce inflation is by pushing interest rates higher which is why governments around the world are trying to keep inflation at the ideal 2%. Letting inflation run like this is a recipe for disaster. Lucky you don't live in Turkey yes Erdogan is applying the opposite of perceived wisdom by cutting rates to bring down inflation. Currently inflation is at 21%, and excluding Food and fuel 17.6% with Interest rates at around 14% and Banks Paying 11% or so on high interest accounts.

|

|

agent69

Member of DD Central

Posts: 6,043

Likes: 4,437

|

Post by agent69 on Dec 19, 2021 13:50:11 GMT

Lucky you don't live in Turkey yes Erdogan is applying the opposite of perceived wisdom by cutting rates to bring down inflation. Currently inflation is at 21%, and excluding Food and fuel 17.6% with Interest rates at around 14% and Banks Paying 11% or so on high interest accounts. I assume this is only for Turkish lira denominated accounts? $ and Euro accounts probably get a bit less.

|

|

tallsuk

Member of DD Central

Posts: 143

Likes: 128

|

Post by tallsuk on Dec 19, 2021 14:05:13 GMT

Turkey is clearly in a very bad way but is raising interest rates to 0.25% appropriate when inflation hits 5% much better?

|

|

|

|

Post by Deleted on Dec 19, 2021 14:20:38 GMT

For the last 10 years all the major countries have been trying to raise inflation rates to 2% or above and have failed time and time again. Japan being the real failure in this. Then along comes a little Covid and we finally get there and people complain....

When interest setting was part of a political process (see Turkey) then this was a concern, but with most central banks now politically disconnected and with clear targets I'd not worry too much in the long term. Short term it will be painful partially because we insist on buying our power from despot/paranoid regimes (Russia, Saudi etc). Now is a good time to race to green energy to calm the price and so inflation

On a different note there has been a recent serious paper that suggests that inflation is not driven by anything but the discussion and reading of the word "inflation" in newspapers/social media. Like Beetlejuice if you want it to go away stop talking about it

|

|

|

|

Post by Deleted on Dec 19, 2021 14:24:09 GMT

Turkey is clearly in a very bad way but is raising interest rates to 0.25% appropriate when inflation hits 5% much better? Yes Turkey is in a completely different position. The leader of the country and hence of the non-independant central bank believes that raising interest raises inflation which is in direct opposition to accepted economic science. As a result he has replaced a lot of senior central bankers over the years as they keep pushing back. Turkey's problem is down to one man being an idiot.

See also, attacking the Kurds, pushing women back into the home, faking a coup etc etc. But the loony religious right like him.

Keith makes a good point about the present level of inflation but perhaps we need to know who publishes the official inflation rate... it is the central bank. In this case no one in Turkey believes that inflation is only 21%

|

|

|

|

Post by Deleted on Dec 19, 2021 14:54:46 GMT

What does everyone else think? Am I just needlessly panicking? It depends, if you are earning on average 12% interest from your investments and you are seeing 5% inflation and your normal lifestyle expenditure is covered in addition then don't worry. If you are in debt then your borrowings will evaporate as long as you have income to cover your lifestyle expenditure.

15% was horrible I don't want to see it again. 5% not so worrying above that over time it destroys profitability of organisations and causes mass unemployment.

|

|

james100

Member of DD Central

Posts: 1,086

Likes: 1,288

|

Post by james100 on Dec 19, 2021 15:07:34 GMT

yes Erdogan is applying the opposite of perceived wisdom by cutting rates to bring down inflation. Currently inflation is at 21%, and excluding Food and fuel 17.6% with Interest rates at around 14% and Banks Paying 11% or so on high interest accounts. I assume this is only for Turkish lira denominated accounts? $ and Euro accounts probably get a bit less. Yes. I used to live in Istanbul (USD, GBP, Euro accounts all "normal") and it never ceased to amaze me how people would keep cash in TRY accounts irrespective of inflation simply because the interest rates were high. I recall a newbie expat telling me how cheap he'd been quoted for a local mortgage at only 1% or so. A little probing revealed that was the monthly rate not the annual one... Financially smart locals would nip to the gold shop after payday, effectively converting their salary to USD and simultaneously taking out of the banking system much of which is owned by the governments (hence the emptying of cashpoints / run on banks during the attempted military coup of 2016). Anyway, I'll spare everyone my views on Turkish economics, politics and in particular their role in NATO because I do tend to get rather boring....but even in Turkish type inflationary environments there are many people who profit greatly from it.

|

|

tallsuk

Member of DD Central

Posts: 143

Likes: 128

|

Post by tallsuk on Dec 19, 2021 15:29:13 GMT

18 years ago, Gordon Brown set the BoE an inflation target of 2%. Although they are able to set rates independently to reach this target, it is still the government that sets the target and appoints the board responsible for making these decisions. Every month that the inflation rate misses this by 1%, above or below, the chair of the committee has to write an open letter to the chancellor explaining why. The BoE is quasi-independent. At least in Turkey they don’t pretend to be anything other than a puppet of government.

Inflation is vital if any economy is to grow. However, too little, or too much is a bad thing. If it get too high, the only way the BoE and control it is to put interest rates up and with household income sitting at over 85% of GDP, high interest rates could have serious consequences.

It is also important to recognise that when interest rates are lower than inflation, lenders lose money as the capital returned is worth less than it is when it is originally lent. Most lenders such as banks and credit card companies will increase their rates to ensure that they don't lose money. It is not as easy to do that with P2P and therefore we are more likely to to be hit as the capital erodes. One of the key issues with high inflation is that at somepoint the BoE will be forced to put interest rates higher than inflation and that is likely to have serious implications for the property market and all lending.

I am not sure what the evidence is that it is talking about inflation that increases it. The currently inflation is far more likely to be driven by high energy rates combined with increased wages. The cheap supply of labour that has sustained the UK for the last 30 years is no longer available.

|

|