littleoldlady

Member of DD Central

Running down all platforms due to age

Posts: 3,017

Likes: 1,835

|

Post by littleoldlady on Apr 13, 2022 20:25:59 GMT

Mezzanine loans in general have not been successful for me and I will never invest in another one in any platform. Like junk bonds if you hold enough the high returns on the ones that don't fail may cover the losses on those that do. But until you have built up sufficient diversity your portfolio is in danger. The underlying problem is that control over the asset in the event of a default lies entirely with the primary lender whose only interest is in getting his investment back, and is not concerned about the mezzanine investors.

|

|

zuluwarrior

Member of DD Central

chap from Newcastle, dabbling here and there. Long-time lurker of the forums

Posts: 78

Likes: 42

|

Post by zuluwarrior on Apr 13, 2022 20:39:51 GMT

Mezzanine loans in general have not been successful for me and I will never invest in another one in any platform. Like junk bonds if you hold enough the high returns on the ones that don't fail may cover the losses on those that do. But until you have built up sufficient diversity your portfolio is in danger. The underlying problem is that control over the asset in the event of a default lies entirely with the primary lender whose only interest is in getting his investment back, and is not concerned about the mezzanine investors. Agree with you. As long as the senior lender gets their dosh back, they couldn't care less about the mezz and second charge lenders. Wouldn't be adverse to secon d charge lending once a project is well underway, sort of finishing up funds. Mezz funding at the start of the project particularly with inexperienced developers and poor deals is very risky. Hopefully they only do mezz on very strong projects, personally I'd like to see more on the project appraisal from CP. LTGDV/LTV to me are risk management metrics, if I can see profitability figures and the profit and stress testing services the debt, I'd much rather than invest than off some LTGDV.

|

|

|

|

Post by overthehill on Apr 14, 2022 11:15:52 GMT

Mezzanine loans in general have not been successful for me and I will never invest in another one in any platform. Like junk bonds if you hold enough the high returns on the ones that don't fail may cover the losses on those that do. But until you have built up sufficient diversity your portfolio is in danger. The underlying problem is that control over the asset in the event of a default lies entirely with the primary lender whose only interest is in getting his investment back, and is not concerned about the mezzanine investors. Agree with you. As long as the senior lender gets their dosh back, they couldn't care less about the mezz and second charge lenders. Wouldn't be adverse to secon d charge lending once a project is well underway, sort of finishing up funds. Mezz funding at the start of the project particularly with inexperienced developers and poor deals is very risky. Hopefully they only do mezz on very strong projects, personally I'd like to see more on the project appraisal from CP. LTGDV/LTV to me are risk management metrics, if I can see profitability figures and the profit and stress testing services the debt, I'd much rather than invest than off some LTGDV.

You can manually request a copy of the valuation document from CP which should have all the project projection figures.

I'm not a fan of 2nd/3rd/mezzanine loans with different primary lenders, I only have a few with LLI for smaller amounts. If the 2nd/3rd charge is with the same lender like Proplend that is a much less risky and predictable scenario with similar returns IMO.

|

|

littleoldlady

Member of DD Central

Running down all platforms due to age

Posts: 3,017

Likes: 1,835

|

Post by littleoldlady on Apr 14, 2022 13:32:03 GMT

Agree with you. As long as the senior lender gets their dosh back, they couldn't care less about the mezz and second charge lenders. Wouldn't be adverse to secon d charge lending once a project is well underway, sort of finishing up funds. Mezz funding at the start of the project particularly with inexperienced developers and poor deals is very risky. Hopefully they only do mezz on very strong projects, personally I'd like to see more on the project appraisal from CP. LTGDV/LTV to me are risk management metrics, if I can see profitability figures and the profit and stress testing services the debt, I'd much rather than invest than off some LTGDV.

I'm not a fan of 2nd/3rd/mezzanine loans with different primary lenders, I only have a few with LLI for smaller amounts. If the 2nd/3rd charge is with the same lender like Proplend that is a much less risky and predictable scenario with similar returns IMO.

I agree to an extent, as it's the same lender, but if the realisation of the asset is insufficient then it's the mezz lenders who will suffer, and the mezz loan is on top of what the platform thought realistic.

|

|

|

|

Post by Ace on Apr 14, 2022 13:44:42 GMT

I'm not a fan of 2nd/3rd/mezzanine loans with different primary lenders, I only have a few with LLI for smaller amounts. If the 2nd/3rd charge is with the same lender like Proplend that is a much less risky and predictable scenario with similar returns IMO.

I agree to an extent, as it's the same lender, but if the realisation of the asset is insufficient then it's the mezz lenders who will suffer, and the mezz loan is on top of what the platform thought realistic. Not necessarily "on top of what the platform thought realistic". Just outside the scope of their 75% max LTV criteria, or warrants more than the standard 6.5% to 8% rate to lenders that CP's first charge loans are priced at.

|

|

dave4

Member of DD Central

Cynical is a hobby not a lifestyle

Posts: 998

Likes: 569

|

Post by dave4 on Apr 26, 2022 17:24:09 GMT

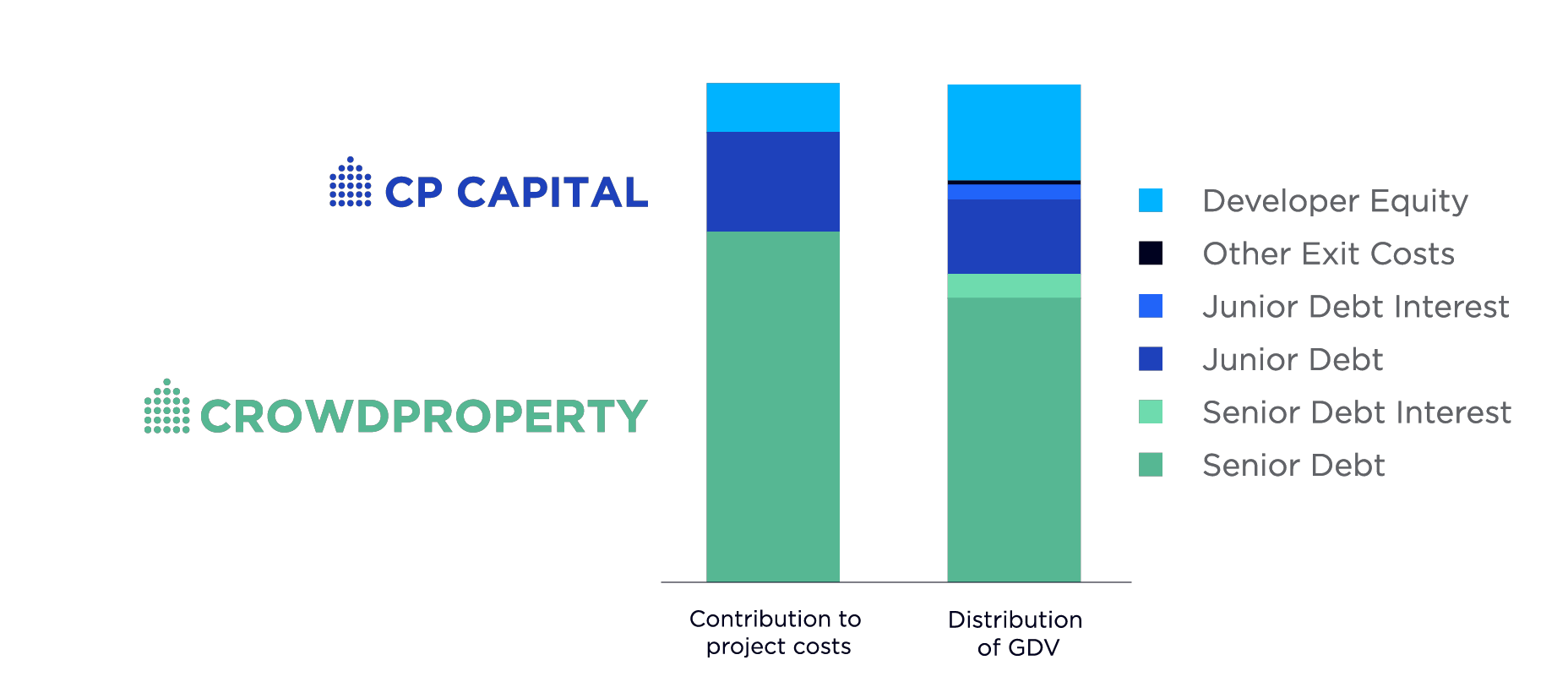

Anyone dipped their toe in the water with the new CP product the launched yesterday? Be good to get views on whether it’s a good investor proposition. www.cpcapital.com/user/registerIt’s described as a ‘second charge mezzanine finance product‘. Based on the mechanics of the main CP platform, looks good. They also invest in their own loans like the main CP setup. The official marketing blurb... CrowdProperty is delighted to announce the launch of CP Capital (www.cpcapital.com), its second charge mezzanine finance product. You could lose all of your money invested in this product. This is a high-risk investment and is much riskier than a savings account. No FSCS protection and capital at risk. See our full Risk Statement. CP Capital funds the same residential property development projects as we always have done at CrowdProperty – small and medium sized development projects in liquid markets serving domestic demand at mainstream price points throughout the UK. All loans are secured by means of a second legal charge against property assets in the projects we back. A second charge secured loan is paid back after the capital and interest commitments of the first legal charge holder (the senior development finance) have been met. Therefore, these investments come with significantly higher risk than first charge secured investments.  All projects with CP Capital mezzanine finance are funded by CrowdProperty as the senior development finance provider (the first charge lender). This ensures that CP Capital security sits behind a rational, project delivery focused and proven senior lender with reliable sources of capital and a value-adding approach. Additionally, CrowdProperty Directors will participate in every CP Capital loan, showing our confidence and commitment in our ability to select and oversee high quality projects being undertaken by high quality property professionals.

|

|

dave4

Member of DD Central

Cynical is a hobby not a lifestyle

Posts: 998

Likes: 569

|

Post by dave4 on May 28, 2022 11:32:35 GMT

#Drovers Meadow, Brecon - 2nd Charge:

Launching at 12pm on Wednesday 1st June.

The minimum investment in a project is £1,000.00

With CP Capital, you are required to have funds in your account ahead of investing in a project. You can do this either via internal transfer from your CrowdProperty/CP Capital account or by making a deposit to your deposit information.

|

|

|

|

Post by Ace on May 28, 2022 15:26:23 GMT

#Drovers Meadow, Brecon - 2nd Charge: Launching at 12pm on Wednesday 1st June. The minimum investment in a project is £1,000.00 With CP Capital, you are required to have funds in your account ahead of investing in a project. You can do this either via internal transfer from your CrowdProperty/CP Capital account or by making a deposit to your deposit information. I noticed that this project in the Coming Soon list on CP reduced from £2.5m at 8% to £1.8235 at 7.8% yesterday. I wonder whether the £676.5k difference will be the size of the junior loan on CPCapital.

|

|

|

|

Post by Ace on May 30, 2022 22:57:45 GMT

#Drovers Meadow, Brecon - 2nd Charge: Launching at 12pm on Wednesday 1st June. The minimum investment in a project is £1,000.00 With CP Capital, you are required to have funds in your account ahead of investing in a project. You can do this either via internal transfer from your CrowdProperty/CP Capital account or by making a deposit to your deposit information. I noticed that this project in the Coming Soon list on CP reduced from £2.5m at 8% to £1.8235 at 7.8% yesterday. I wonder whether the £676.5k difference will be the size of the junior loan on CPCapital. I was wrong. The CPC loan is for £260.5k. It's at a rate to lenders of 16.5%. A much higher risk than CP's standard offerings, but fairly priced compared to other mezzanine loans IMO. I welcome this addition to the higher risk end of my portfolio from a platform that I trust to get the loan DD right and to manage the loan. It looks like the addition of these CPC loans will be good news for CP lenders too. This loan alone has allowed them to add a £3.5m loan to CP that would not have been possible without the extra CPC mezzanine loan. A major plus point for me is that the CP ISA funds can be shared with CPC, effectively allowing a single year's allowance to be spread over 2 IFISAs. Also, the funds can be freely and instantly transferred between the two (sub)platforms without the usual ISA transfer forms. Will be interesting to see how fast it goes. I'm going to try for a slice.

|

|

littleoldlady

Member of DD Central

Running down all platforms due to age

Posts: 3,017

Likes: 1,835

|

Post by littleoldlady on May 31, 2022 7:58:56 GMT

If I was ever tempted to invest in a mezzanine loan (unlikely) it would be with CPC as the most serious risk (disinterest by the senior lender in recovery beyond their own share) is eliminated. However it will still take time to build a large enough portfolio to get sufficient diversity. And deepish pockets at a grand a pop.

|

|

|

|

Post by Ace on Jun 1, 2022 11:04:30 GMT

Did anyone get a slice. I tried, but my fingers weren't fast enough. It went immediately.

|

|

|

|

Post by Penny Pincher on Jun 1, 2022 11:09:05 GMT

Did anyone get a slice. I tried, but my fingers weren't fast enough. It went immediately. Not me. I might have, had I not pledged more than was available first time around. It was fully funded before my second attempt.

|

|

|

|

Post by scrumper on Jun 1, 2022 11:18:08 GMT

I don't know how it's organised. Try again now.

|

|

|

|

Post by Ace on Jun 1, 2022 11:19:13 GMT

It now looks like I have got a slice. All very confusing. It's gone from £4k overfunded to 56% funded, then 76% funded, now 74% funded.

|

|

|

|

Post by Penny Pincher on Jun 1, 2022 12:26:00 GMT

That's bizarre, I've just made a third attempt, an hour and half later and got what I wanted! If it wasn't for the posts above, I wouldn't have returned to the site today. Thanks scrumper , Ace . |

|