|

|

Post by freefalljunkie on Aug 20, 2020 9:11:16 GMT

I may be misunderstanding a finer point and i don't intend to use it - but is 5 yr shut down as the investment box is live with 1m on the market or do you mean in a different way? See diversifier 's earlier post - 'shut down' in the sense of not open to anyone who isn't already invested in it and not doing any new lending. No, I don’t agree with that point at all. You’re taking the success criterion as queue-length (which is affected by continued lending in one market). The real success criterion, which I used in my original post, was: does this product meet customer expectations, providing an ongoing business. Queue-length affects that, but it’s a larger question. The 5yr account was a very *good* control group. It was an existing product, with 10yr history and a loyal customer base. Events since have shown that even in the face of a pandemic, it’s existing customer base continues with some loyalty. You, for example. In fact, in the absence of other events, 5yr could probably *slow down* RYI processing a bit at this point, having shown some progress, as long as RS could demonstrate a bit more visibility and plan, as how the time-lag could be steadily reduced to zero over the next six months. 5yr investors would tolerate that, if there were a long-term recovery plan for both Provision Fund and interest rates to rise back above 6%. Whereas, the APM customers are burnt so bad, that the reputational impact is not survivable. No new investor would ever invest in Ratesetter, whatever the true details, given what their first google search will turn up. Anyone who thinks that “improved market sentiment” will make a difference to that is plain not thinking straight. With respect, it was you that took the queue as the success criterion that drove your description of what was happening in each market: [...] A) 5yr account Ts and Cs was (approximately) what RS set up to do. Outcome: initial liquidity crisis, but now starting to ease. Queue may potentially shrink to near zero within 6-8 months from initial crisis. [...] B) APM account has totally different Ts and Cs Outcome: liquidity crisis has worsened, stalling entirely well before the peak withdrawal. There is no chance really that any of those investors will get their money back inside a couple of years. [...] I was only operating within these goalposts. But you keep moving these goalposts so much with every post that these debates are so frustrating... You're also not taking into account the extent to which RYI processing speed itself affects this 'loyalty'. Are you honestly telling me that, were the situation reversed and the A/P/M RYI queue was speeding along with the 5 Year queue not moving at all, that it wouldn't just be the other way around? I don't know how this argument can be made with a straight face... (Also, why am I a 'loyal customer' for 5 Year? My investment there was RYI'd months ago...)

|

|

chris1200

Member of DD Central

Posts: 827

Likes: 508

|

Post by chris1200 on Aug 20, 2020 9:11:29 GMT

You’re confusing “we” us on this forum, and “we” all investors in RS. (The discussion was also about ‘game over’ in the sense of no future lending after the takeover; not in the sense of assessing the current loanbook/RYI queue.) Being pedantic again? Wow, so many on this forum are of the rather authoritarian "I've had enough of experts", don't like having it pointed out to them when they might have got it a bit wrong variety, aren't they... Don't post on here if you're going to react so negatively and so personally to someone entirely politely responding to your post (especially when you were responding to mine?!)  It's not pedantic to suggest that there's a huge difference between the minority of much more aware investors on this forum, and the entire mass of investors - many of whom don't seem to have a clue what's going on, judging by their consistent reinvestment. It's also not pedantic to point out that we meant something completely different by 'game over'. Surprised beagle liked your post given only a few days ago he was accusing you of not reading his own post before responding - but the tribal behaviour on here is more than a little incomprehensible at this point.

|

|

chris1200

Member of DD Central

Posts: 827

Likes: 508

|

Post by chris1200 on Aug 20, 2020 9:12:56 GMT

Ha! Very accurate... Although, in my defence, the majority of my post was quotations, and I quickly regretted and relented

|

|

littleoldlady

Member of DD Central

Running down all platforms due to age

Posts: 3,045

Likes: 1,862

|

Post by littleoldlady on Aug 20, 2020 9:15:38 GMT

I would not be surprised if the Metro take over did not happen, for two reasons.

Firstly RS will not have funds to make many new loans before the end of the year.

Secondly my analysis of RS stats suggests that the rate of topping up the PF will not be sufficient to repay all investors' capital. If RS pay out investors at the front of the RYI queue capital and interest in full, whilst those further back lose capital, after RS have set the precedent of diverting 50% of interest (instead of 100%) into the PF then Metro might worry that they will be on the hook for compensation despite any prior claim to non-liability.

I would also not be surprised if RS realise this and increase the diversion rate to 100% with a promise to pay any excess as deferred interest.

|

|

chris1200

Member of DD Central

Posts: 827

Likes: 508

|

Post by chris1200 on Aug 20, 2020 9:38:20 GMT

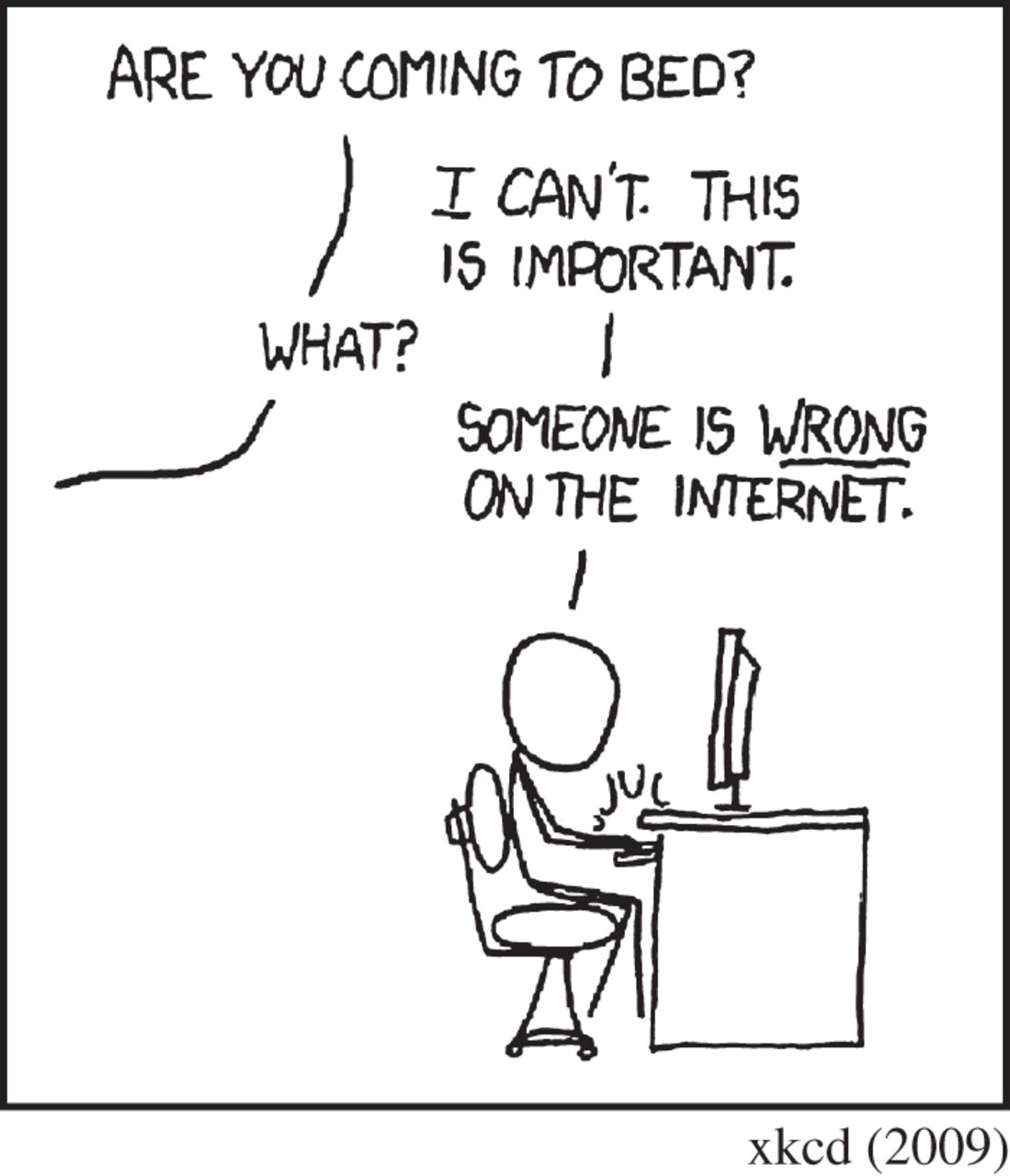

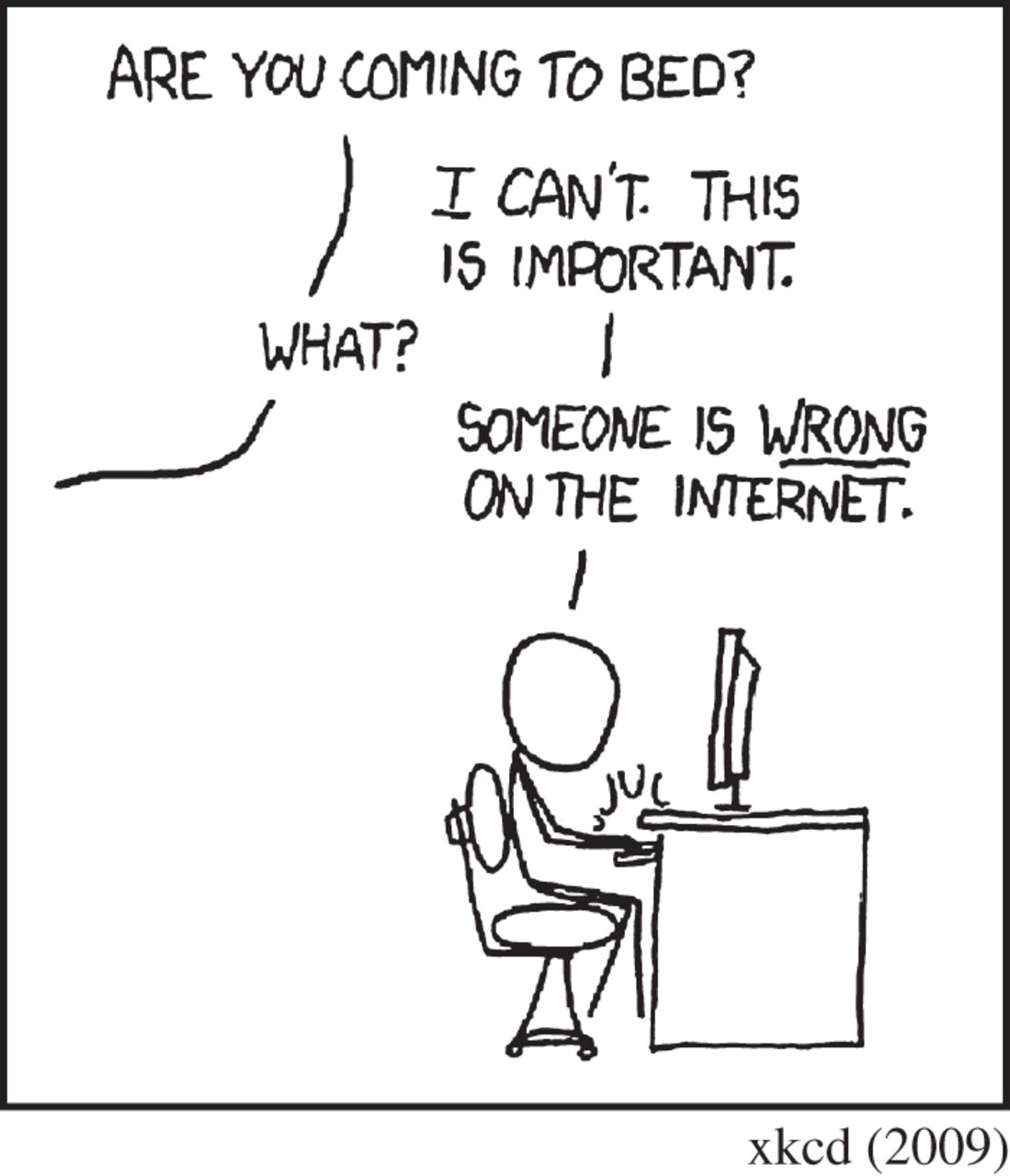

Wow, so many on this forum are of the rather authoritarian "I've had enough of experts", don't like having it pointed out to them when they might have got it a bit wrong variety, aren't they... Don't post on here if you're going to react so negatively and so personally to someone entirely politely responding to your post (especially when you were responding to mine?!)  It's not pedantic to suggest that there's a huge difference between the minority of much more aware investors on this forum, and the entire mass of investors - many of whom don't seem to have a clue what's going on, judging by their consistent reinvestment. It's also not pedantic to point out that we meant something completely different by 'game over'. Surprised beagle liked your post given only a few days ago he was accusing you of not reading his own post before responding - but the tribal behaviour on here is more than a little incomprehensible at this point. Maybe you should follow your own advice. I don't think I made any personal or negative characterisations about you? (Whereas you called me pedantic.) I just responded entirely politely to your post in my belief that you had misinterpreted what we were talking about (which I'm allowed to do). If you can't see the difference... then I don't know what to tell you. See here for an example of how delightful and friendly conversations involving suggestions of a mistake or error can be

|

|

beagle

Investor in ratesetter, funding circle, lendy (lesson learnt) and AC

Posts: 670

Likes: 322

|

Post by beagle on Aug 20, 2020 9:47:18 GMT

Wow, so many on this forum are of the rather authoritarian "I've had enough of experts", don't like having it pointed out to them when they might have got it a bit wrong variety, aren't they... Don't post on here if you're going to react so negatively and so personally to someone entirely politely responding to your post (especially when you were responding to mine?!)  It's not pedantic to suggest that there's a huge difference between the minority of much more aware investors on this forum, and the entire mass of investors - many of whom don't seem to have a clue what's going on, judging by their consistent reinvestment. It's also not pedantic to point out that we meant something completely different by 'game over'. Surprised beagle liked your post given only a few days ago he was accusing you of not reading his own post before responding - but the tribal behaviour on here is more than a little incomprehensible at this point. I liked the post as I found it comical. Please do not drag me into these endless debates and huge essays.

|

|

chris1200

Member of DD Central

Posts: 827

Likes: 508

|

Post by chris1200 on Aug 20, 2020 9:49:05 GMT

I liked the post as I found it comical. Please do not drag me into these endless debates and huge essays. You're definitely not one to engage in a debate on here, eh

|

|

|

|

Post by freefalljunkie on Aug 20, 2020 10:20:16 GMT

I would not be surprised if the Metro take over did not happen, for two reasons. Firstly RS will not have funds to make many new loans before the end of the year. Secondly my analysis of RS stats suggests that the rate of topping up the PF will not be sufficient to repay all investors' capital. If RS pay out investors at the front of the RYI queue capital and interest in full, whilst those further back lose capital, after RS have set the precedent of diverting 50% of interest (instead of 100%) into the PF then Metro might worry that they will be on the hook for compensation despite any prior claim to non-liability. I would also not be surprised if RS realise this and increase the diversion rate to 100% with a promise to pay any excess as deferred interest. Since it has been formally announced I was under the impression that the acquisition must be a done deal subject to regulatory approval.

Does anyone know what the proposed timescale is for Ratesetter becoming part of Metro Bank?

|

|

chris1200

Member of DD Central

Posts: 827

Likes: 508

|

Post by chris1200 on Aug 20, 2020 10:25:43 GMT

Since it has been formally announced I was under the impression that the acquisition must be a done deal subject to regulatory approval.

Does anyone know what the proposed timescale is for Ratesetter becoming part of Metro Bank?

Agree this is likely - although it slightly depends on what conditions precedent/conditions subsequent are in the agreement. In terms of timing, all I've seen is that they expect completion by Q4 this year. The agreement will likely have a long-stop date in it, but, again, this won't likely be public.

|

|

iRobot

Member of DD Central

Posts: 1,680

Likes: 2,477

|

Post by iRobot on Aug 20, 2020 10:29:37 GMT

I would not be surprised if the Metro take over did not happen, for two reasons. Firstly RS will not have funds to make many new loans before the end of the year. Secondly my analysis of RS stats suggests that the rate of topping up the PF will not be sufficient to repay all investors' capital. If RS pay out investors at the front of the RYI queue capital and interest in full, whilst those further back lose capital, after RS have set the precedent of diverting 50% of interest (instead of 100%) into the PF then Metro might worry that they will be on the hook for compensation despite any prior claim to non-liability. I would also not be surprised if RS realise this and increase the diversion rate to 100% with a promise to pay any excess as deferred interest. Since it has been formally announced I was under the impression that the acquisition must be a done deal subject to regulatory approval.

Does anyone know what the proposed timescale is for Ratesetter becoming part of Metro Bank?

From MB's RNS on Aug 3rd: " The acquisition is conditional upon approval from the Financial Conduct Authority and shareholders holding at least 60 percent of RateSetter's shares acceding to the relevant transaction documents and is expected to close by the fourth quarter this year. " Some wriggle room there - depends if you interpret 'by the 4th qtr' to include the 4th qtr. Could be interpreted as being by the end of September, but that would seem ambitious, to me.

|

|

|

|

Post by freefalljunkie on Aug 20, 2020 10:53:48 GMT

Thanks, does sound like the timescales are a bit flexible. On further query has occurred to me. Done anyone know if the conditions the FCA may attached to a deal like this are made public? I was wondering if we would get to hear about conditions if any which they may impose regarding the future treatment of Ratesetter's lenders.

|

|

chris1200

Member of DD Central

Posts: 827

Likes: 508

|

Post by chris1200 on Aug 20, 2020 11:06:43 GMT

Thanks, does sound like the timescales are a bit flexible. On further query has occurred to me. Done anyone know if the conditions the FCA may attached to a deal like this are made public? I was wondering if we would get to hear about conditions if any which they may impose regarding the future treatment of Ratesetter's lenders. Hmmm good question. The CMA certainly publishes its decisions regarding merger control cases so that's always very public; but I don't recall ever seeing an FCA approval decision re an acquisition/change of control. Maybe someone else has? If not, it might well then depend on whether the companies in question announce any details themselves, which itself could be influenced by reporting requirements for MB given they are listed...

|

|

Greenwood2

Member of DD Central

Posts: 4,376

Likes: 2,780

|

Post by Greenwood2 on Aug 20, 2020 11:07:19 GMT

Thanks, does sound like the timescales are a bit flexible. On further query has occurred to me. Done anyone know if the conditions the FCA may attached to a deal like this are made public? I was wondering if we would get to hear about conditions if any which they may impose regarding the future treatment of Ratesetter's lenders. RS have told lenders that nothing will change, and I assume they will assure the FCA of that. If RS continue to work within the scope of the existing lender T&Cs (which give RS a lot of scope!) I would assume the FCA would leave them to it. Edit: Crossed with previous post.

|

|

macq

Member of DD Central

Posts: 1,934

Likes: 1,199

|

Post by macq on Aug 20, 2020 11:27:42 GMT

I would not be surprised if the Metro take over did not happen, for two reasons. Firstly RS will not have funds to make many new loans before the end of the year. Secondly my analysis of RS stats suggests that the rate of topping up the PF will not be sufficient to repay all investors' capital. If RS pay out investors at the front of the RYI queue capital and interest in full, whilst those further back lose capital, after RS have set the precedent of diverting 50% of interest (instead of 100%) into the PF then Metro might worry that they will be on the hook for compensation despite any prior claim to non-liability. I would also not be surprised if RS realise this and increase the diversion rate to 100% with a promise to pay any excess as deferred interest. All Metro want is the infrastructure to use for their own (and maybe institutional?) money and i assume think this is easier then starting from scratch or fighting others for the best bits of RS if they had gone under so not sure they are worried about point One.And as it is all but a rescue package in name you would hope they will be clear at some point what the current investors can expect The second point about non-liability would you assume be water tight in any agreement unless maybe the FCA did not like something and tried to interfere.Without any updates it seems that its good news that the staff of RS will have a main job and an office where they will be running the Metro side and as a second part of the operation run down the RS book but you do wonder how that will work Once the recycling of funds stops if there is to be no new investing

|

|

|

|

Post by diversifier on Aug 21, 2020 9:51:19 GMT

I would not be surprised if the Metro take over did not happen, for two reasons. Firstly RS will not have funds to make many new loans before the end of the year. Secondly my analysis of RS stats suggests that the rate of topping up the PF will not be sufficient to repay all investors' capital. If RS pay out investors at the front of the RYI queue capital and interest in full, whilst those further back lose capital, after RS have set the precedent of diverting 50% of interest (instead of 100%) into the PF then Metro might worry that they will be on the hook for compensation despite any prior claim to non-liability. I would also not be surprised if RS realise this and increase the diversion rate to 100% with a promise to pay any excess as deferred interest. All Metro want is the infrastructure to use for their own (and maybe institutional?) money and i assume think this is easier then starting from scratch or fighting others for the best bits of RS if they had gone under so not sure they are worried about point One.And as it is all but a rescue package in name you would hope they will be clear at some point what the current investors can expect The second point about non-liability would you assume be water tight in any agreement unless maybe the FCA did not like something and tried to interfere.Without any updates it seems that its good news that the staff of RS will have a main job and an office where they will be running the Metro side and as a second part of the operation run down the RS book but you do wonder how that will work Once the recycling of funds stops if there is to be no new investing “How It Will Work once the recycling stops”. I just realised there is an angle here for Metro. There is always an angle. Once the music stops in December, you’ve got £700m’ish of account holders in the same position as now, no RYIs, and drip-drip of money for the next several years. Everybody will be desperate to avoid logging in regularly for five years, but what can you do? Metro could just be kind, and implement a daily auto sweeper for everybody, but what’s in that for them? I reckon they’ll offer (it’s up to you!) a daily autosweeper from Holding, into any *Metro* bank account, offering say 0.5%. That would be so generous of them. Of course, you’re perfectly free to transfer money out of that to wherever you like, subject to the Ts and Cs of that Metro account. Since your alternative is to log in really regularly to avoid your money sitting in the 0% holding account, the only rational course of action is to accept, even while muttering about “taking the p*”. And suddenly, Metro get a guaranteed stream of normal bank depositors of £700m, for their £11m, on whom they expect to make money like any bank. And it’s a great book, consisting largely of medium to high net worth people, as opposed to endless streams of low-value student accounts. Metro can sell them additional investment products too.

|

|