ozboy

Member of DD Central

Mine's a Large One! (Snigger, snigger .......)

Posts: 3,161

Likes: 4,847

|

Post by ozboy on May 26, 2023 14:26:23 GMT

26/5/23 @ 15:23 - "Withdrawals are unavailable at this time - they will be enabled once the current series of loan repayments have been made."

May the farce be with you!

|

|

|

|

Post by beepbeepimajeep on May 26, 2023 14:36:21 GMT

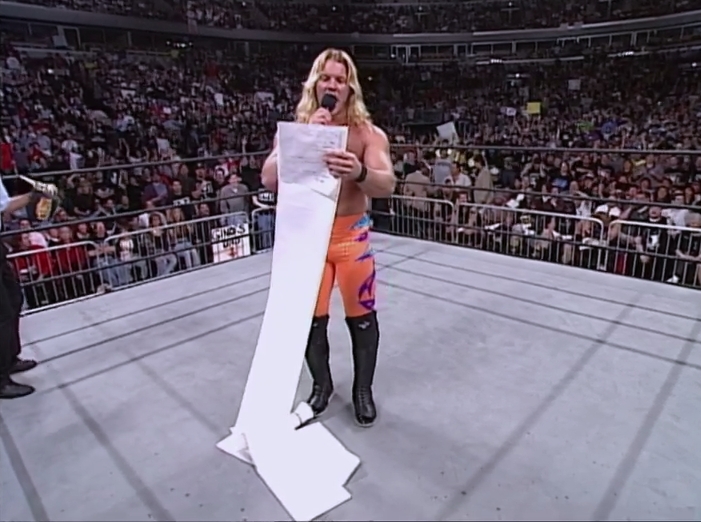

26/5/23 @ 15:23 - "Withdrawals are unavailable at this time - they will be enabled once the current series of loan repayments have been made."Me looking at my list of loans still to be repaid

|

|

ozboy

Member of DD Central

Mine's a Large One! (Snigger, snigger .......)

Posts: 3,161

Likes: 4,847

|

Post by ozboy on May 26, 2023 15:15:06 GMT

We've had a result (of sorts) recently with Collateral.

SURELY we can expect similar results with Funding Insecure?

|

|

|

|

Post by tedbob on May 26, 2023 17:52:06 GMT

I have two loans "recovered" and credited to my balance today, at around 50% of the amount invested.

Can't actually withdraw the money yet. I think the administrators are waiting to update all loans repaid/recovered first so that people can withdraw in one go in 3 to 4 working days, rather than having too many withdrawals to process.

Happy that, after 2.5 years, I will get some payments again. If it's around 50% of the money invested, it will be more than I was expecting at that point.

|

|

|

|

Post by df on May 26, 2023 19:11:00 GMT

There was an e-mail 2 days ago saying "Following an internal review it was identified that a small over-payment was made to a number of investors in December 2019. In order to correct this a debit will therefore be applied to those investors affected, correcting this error." It appears that I'm one of them. My balance was £0.32, now it is £-0.03. I wonder if my remaining loan book doesn't bring me any more crumbs, which is a very likely scenario, administrators will ask me to pay them 3p  |

|

r1200gs

Member of DD Central

Posts: 1,336

Likes: 1,883

|

Post by r1200gs on May 26, 2023 20:05:10 GMT

There was an e-mail 2 days ago saying "Following an internal review it was identified that a small over-payment was made to a number of investors in December 2019. In order to correct this a debit will therefore be applied to those investors affected, correcting this error." It appears that I'm one of them. My balance was £0.32, now it is £-0.03. I wonder if my remaining loan book doesn't bring me any more crumbs, which is a very likely scenario, administrators will ask me to pay them 3p  I once received about 6 letters, two phone calls (who THEN checked the amount they were trying to chase and who apologised) and the threat of legal action over 3 Euro cents. It was a credit card I had cancelled. You cannot pay 3 cents via the Belgian transfer system and when I called the offices, they could not accept cash when I was passing. So, beware a CCJ. ;-)

|

|

kermie

Member of DD Central

Posts: 691

Likes: 462

|

Post by kermie on May 26, 2023 20:07:20 GMT

There was an e-mail 2 days ago saying "Following an internal review it was identified that a small over-payment was made to a number of investors in December 2019. In order to correct this a debit will therefore be applied to those investors affected, correcting this error." It appears that I'm one of them. My balance was £0.32, now it is £-0.03. I wonder if my remaining loan book doesn't bring me any more crumbs, which is a very likely scenario, administrators will ask me to pay them 3p  The lack of detail in their emails is astounding. No mention of which loans or what sort of percentages (even a range) - just an expectation that we'll cross our fingers and take our medicine and be grateful. Atrocious.

|

|

iRobot

Member of DD Central

Posts: 1,678

Likes: 2,473

|

Post by iRobot on May 26, 2023 20:17:59 GMT

There was an e-mail 2 days ago saying "Following an internal review it was identified that a small over-payment was made to a number of investors in December 2019. In order to correct this a debit will therefore be applied to those investors affected, correcting this error." It appears that I'm one of them. My balance was £0.32, now it is £-0.03. I wonder if my remaining loan book doesn't bring me any more crumbs, which is a very likely scenario, administrators will ask me to pay them 3p  Oh I'm sure a set of circumstances could be carefully crafted up that, amazingly, beyond all expectation, delivers you that thruppence - just so it can be taken back. We really can't have them going without now, can we! But if you do get asked for it - please, please, please send them a cheque - I'll even pay the postage for you  Just be sure you leave it late enough such that the cost of them processing the payment isn't passed onto other lenders... Which leads me to ask: " Following an internal review it was identified that a small over-payment was made... " - and who pays for that 'internal review'? I wonder. " In order to correct this a debit will therefore be applied... " - and who pays for the effort / time to enact that correction? I wonder.

|

|

r1200gs

Member of DD Central

Posts: 1,336

Likes: 1,883

|

Post by r1200gs on May 27, 2023 7:06:43 GMT

I had some cash put in today but its not clear which loan or both. Two of my loans updated (charter house) and another smaller one. If it is mainly charter house my 15% LTV investment returned about a fifth of the capitol. Which Charter house loan is this? The priority loan of 2938283517 £575 had a recovery of 1.3 million to cover it and is still showing in my list of loans, it surely cannot return 15 percent?! My recovery is 1018041290 but I can't see what it was.

|

|

ilmoro

Member of DD Central

'Wondering which of the bu***rs to blame, and watching for pigs on the wing.' - Pink Floyd

Posts: 11,097

Likes: 11,297

|

Post by ilmoro on May 27, 2023 8:09:39 GMT

I had some cash put in today but its not clear which loan or both. Two of my loans updated (charter house) and another smaller one. If it is mainly charter house my 15% LTV investment returned about a fifth of the capitol. Which Charter house loan is this? The priority loan of 2938283517 £575 had a recovery of 1.3 million to cover it and is still showing in my list of loans, it surely cannot return 15 percent?! My recovery is 1018041290 but I can't see what it was. Str**d Rd Lon***Derry. Should be able to search the loan number in your loan history. Also a list in DD. If CH is still showing then suggests funds not distributed yet ...

|

|

r1200gs

Member of DD Central

Posts: 1,336

Likes: 1,883

|

Post by r1200gs on May 27, 2023 8:58:38 GMT

Which Charter house loan is this? The priority loan of 2938283517 £575 had a recovery of 1.3 million to cover it and is still showing in my list of loans, it surely cannot return 15 percent?! My recovery is 1018041290 but I can't see what it was. Str**d Rd Lon***Derry. Should be able to search the loan number in your loan history. Also a list in DD. If CH is still showing then suggests funds not distributed yet ... Thank you, very helpful and reassuring. I have far too much at stake with 2938283517 and I'm absolutely bricking it in case they don't give the loan the priority it should get, the delay is not doing my mental health any damned good at all.

|

|

|

|

Post by overthehill on May 27, 2023 9:12:46 GMT

Str**d Rd Lon***Derry. Should be able to search the loan number in your loan history. Also a list in DD. If CH is still showing then suggests funds not distributed yet ... Thank you, very helpful and reassuring. I have far too much at stake with 2938283517 and I'm absolutely bricking it in case they don't give the loan the priority it should get, the delay is not doing my mental health any damned good at all.

From memory, CH N** Bri* 2938283517 was a standalone loan for refurbishment, legalities still in progress even though building was sold, my old notes say 100% recovery plus interest but that is ignoring administration nuances.

There is also an unhelpfully titled CH development loan with multiple tranches and supplemental loans for 2.5M or such, I wasn't in that loan and I can't recall what it looked like or where it was.

|

|

r1200gs

Member of DD Central

Posts: 1,336

Likes: 1,883

|

Post by r1200gs on May 27, 2023 9:30:22 GMT

Thank you, very helpful and reassuring. I have far too much at stake with 2938283517 and I'm absolutely bricking it in case they don't give the loan the priority it should get, the delay is not doing my mental health any damned good at all.

From memory, CH N** Bri* 2938283517 was a standalone loan for refurbishment, legalities still in progress even though building was sold, my old notes say 100% recovery plus interest but that is ignoring administration nuances.

There is also an unhelpfully titled CH development loan with multiple tranches and supplemental loans for 2.5M or such, I wasn't in that loan and I can't recall what it looked like or where it was.

Good memory, though the loan was for the purchase. "This is a renewal of loan ref 2807104089. This means the borrower has paid the interest to-date to extend the loan for a further 6 months

This is a 6-month loan secured by a first legal charge against a property in ............ ..........The client used the funds to purchase the property and has taken out further loans totalling £1,870,000 to fund the development work on the site.

This loan ranks above all other loans in the event of a default - the LTV on this loan is therefore 15.4%"The loan was £575,000 and should be covered by a recovery of 1.3 million so in theory it should be good for full capital and interest yet I am bricking it. According to one poster, at least one of these loans on this building has already paid back circa 15 percent of capital. I nearly had a heart attack when I read that!

|

|

ilmoro

Member of DD Central

'Wondering which of the bu***rs to blame, and watching for pigs on the wing.' - Pink Floyd

Posts: 11,097

Likes: 11,297

|

Post by ilmoro on May 27, 2023 9:53:15 GMT

Just because all administrator reports might legally need a paper copy rubber stamped in red ink and stored for at least 10 years in a dusty filing cabinet somewhere doesn't mean it's not 1970s technology! The legal profession still needs dragging into the 21st century.... and we're almost a quarter of the way through it already! If you thought the email copy was bad, just look at the upload to CH ... its got more cant than the Leaning Tower

|

|

ilmoro

Member of DD Central

'Wondering which of the bu***rs to blame, and watching for pigs on the wing.' - Pink Floyd

Posts: 11,097

Likes: 11,297

|

Post by ilmoro on May 27, 2023 11:52:06 GMT

Perhaps michaelc could clarify which loan ID numbers he's had distributions from so we can work out the actual situation & maybe calm some nerves. 🥴 |

|