iulia

New Member

Posts: 4

|

Hi

Oct 2, 2015 18:53:06 GMT

Post by iulia on Oct 2, 2015 18:53:06 GMT

Just wanted to introduce myself before posting  I opened a zopa account a few years ago cos I was interested but a bit suspicious, so put a tiny amount in to see what happened. I have a little more to invest now, and recently put an equal but fairly modest amount in zopa, ratesetter and landbay, thought I would watch and see what ended up being better. I was doing research to see if any of the higher interest companies had satisfied customers, hence arriving on this forum. The returns look good, but I feel that anything offering 12% upwards must be fairly high risk. Which is ok if you have the money to risk, I just never realised there were so MANY options out there now ..... Anyway I'm reading with interest. Thanks |

|

registerme

Member of DD Central

Posts: 6,624

Likes: 6,437

|

Hi

Oct 2, 2015 19:05:40 GMT

Post by registerme on Oct 2, 2015 19:05:40 GMT

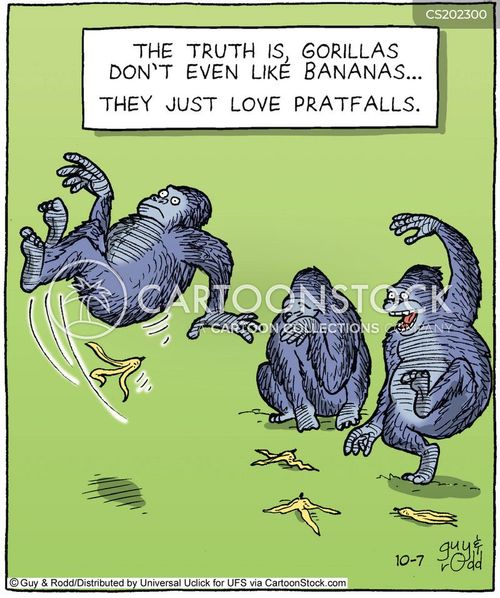

Welcome  . Just avoid anything too banana related anywhere near oldgrumpy  . |

|

iulia

New Member

Posts: 4

|

Hi

Oct 2, 2015 19:21:03 GMT

Post by iulia on Oct 2, 2015 19:21:03 GMT

bananas. Got it  |

|

oldgrumpy

Member of DD Central

Posts: 5,087

Likes: 3,233

|

Post by oldgrumpy on Oct 2, 2015 21:09:57 GMT

Welcome  . Just avoid anything too banana related anywhere near oldgrumpy  .

|

|

Investor

Member of DD Central

Posts: 662

Likes: 590

|

Hi

Oct 3, 2015 0:00:55 GMT

Post by Investor on Oct 3, 2015 0:00:55 GMT

Plantain his foot right in it

|

|

ilmoro

Member of DD Central

'Wondering which of the bu***rs to blame, and watching for pigs on the wing.' - Pink Floyd

Posts: 11,329

Likes: 11,549

|

Post by ilmoro on Oct 3, 2015 0:12:58 GMT

Welcome  . Just avoid anything too banana related anywhere near oldgrumpy  .

|

|

|

|

Post by brokenbiscuits on Oct 3, 2015 8:38:59 GMT

Just wanted to introduce myself before posting  I opened a zopa account a few years ago cos I was interested but a bit suspicious, so put a tiny amount in to see what happened. I have a little more to invest now, and recently put an equal but fairly modest amount in zopa, ratesetter and landbay, thought I would watch and see what ended up being better. I was doing research to see if any of the higher interest companies had satisfied customers, hence arriving on this forum. The returns look good, but I feel that anything offering 12% upwards must be fairly high risk. Which is ok if you have the money to risk, I just never realised there were so MANY options out there now ..... Anyway I'm reading with interest. Thanks Zopa and ratesetter are probably the safest sites around. Slow, steady returns with little risk of capital loss. Good starting point. Your age , risk appetite and required income/target wealth may lead you to other platforms. This is a good site to look around. Another is this one www.4thway.co.ukThey have carried out risk assessments of a number of p2p sites. Some here go for the all in approach. Invest evenly across, say 20 platforms, so if one platform fails or underperforms you are limited to a small loss. Others pick 4 or 5 to "dip their toe" and then often weight the one over time they find works for them. For me I've heavily invested in what I consider to be the safest platform, ratesetter, and over time will slowly move up the risk reward scale making a pyramid looking investment platform. The most money invested in the "safe" stuff, a little less in the medium risk, and then less again in the ones that are more likely to result in capital loss but offer high returns. No right answer, just depends on how you feel about risk and reward.

|

|

iulia

New Member

Posts: 4

|

Hi

Oct 3, 2015 12:14:34 GMT

Post by iulia on Oct 3, 2015 12:14:34 GMT

thanks - very helpful post.

I suppose I was thinking about a similar strategy - letting some sit in the lower risk areas for a while to see how it goes, and then moving a little into a higher risk.

I'm just bewildered by all the options now .....!

|

|

min

Member of DD Central

Posts: 615

Likes: 182

|

Hi

Oct 4, 2015 16:32:56 GMT

iulia likes this

Post by min on Oct 4, 2015 16:32:56 GMT

thanks - very helpful post. I suppose I was thinking about a similar strategy - letting some sit in the lower risk areas for a while to see how it goes, and then moving a little into a higher risk. I'm just bewildered by all the options now .....! When you get to my age you'll just be bewildered!

|

|

|

|

Post by Deleted on Oct 4, 2015 20:15:56 GMT

The other issue is that RateSetter requires you to input very little time.

Most other P2P portals will consume time, I've recently added my sixth portal. Before I did this I spent half a day read this site over a fortnight, checking some competitors and trying to understand how the system works. I also asked a bunch of questions which were thankfully answered by the good people here.

My first 8 investments on this new portal took an hour.

Some portals need more time, those that only offer 6 month loans need more time again.

My advice is

1) Take your time

2) What sort of businesses do you have experience of, so if you know about pawn broking look at those sort of portals, if house development then look at those

3) Keep your loans small until you understand how it works

Edit

FC has moved to fixed bands %, but you will need to read all the details of each deal (basically some of the deals appear to me to be in the wrong bands), rates are poorish and you pay the management cost, complicated

MT is a pawn shop, a wide range of goods and with "managed accounts" that have a rolling mix of products, less to read, 1% a month, struggling to get a loan stream going, but very simple

FS is a pawn shop (really) as above but a good stream of varied products, ~1% per month, very simple

AC slow moving complicated website with lots of delays and lots to read, management all over the place trying to make strategic changes, certainly not an attractive site at the moment, but making lots of changes so maybe in 3 to 6 months it will be back where it was last year. complicated

SS simple website, very large loans (but you can make relatively small loans) with a lot to read, so like AC but simple and low overhead, ~1% per month, simple

So, if I was starting again I'd only look at RS (as you are) and MT/FS/SS, you can join all three and make no payments or loans until you feel comfortable then work with your favorite one.

Good luck

|

|