adrianc

Member of DD Central

Posts: 9,988

Likes: 5,131

Member is Online

|

Post by adrianc on Jun 7, 2021 8:51:06 GMT

Point 1: Agreed. If the choice is actual dollars or Tether and nothing else, I'd go with actual dollars unless I felt there was a risk of the my assets being seized. Why would there be a risk of that...? Unless, of course, your assets were illegal. So we're all agreed that Tether is nothing more than a very-high-risk money-laundering route?

|

|

r00lish67

Member of DD Central

Posts: 2,692

Likes: 4,048

|

Post by r00lish67 on Jun 7, 2021 9:36:35 GMT

Guardian: China blocks cryptocurrency Weibo accounts in ‘judgment day’ for bitcoin.

It's not often I'm in agreement with Chinese government media mouthpieces, but I think they've summed it up rather well. "State broadcaster CCTV has said cryptocurrency is a lightly regulated asset often used in black market trade, money laundering, arms smuggling, gambling and drug dealing." Add being a big driver of ransomware and damage to the environment, and we're near a full house. If it is the future, it's a pretty bleak one.

|

|

james100

Member of DD Central

Posts: 1,084

Likes: 1,287

|

Post by james100 on Jun 7, 2021 9:43:56 GMT

Point 1: Agreed. If the choice is actual dollars or Tether and nothing else, I'd go with actual dollars unless I felt there was a risk of the my assets being seized. Why would there be a risk of that...? Unless, of course, your assets were illegal. So we're all agreed that Tether is nothing more than a very-high-risk money-laundering route? I've had multiple incidents of having my assets frozen and/or accounts investigated for suspected money laundering as a result of bank incompetence and a dodgy government (not this one  ). It's a PITA and doesn't just happen to criminals.

|

|

r00lish67

Member of DD Central

Posts: 2,692

Likes: 4,048

|

Post by r00lish67 on Jun 7, 2021 9:45:32 GMT

With that news, and also articles like this and this from the UK point of view, I think it's fair to say the net is closing in. And it honestly needs to be. Bitcoin existing is fine, but the idea of a currency/asset operating totally out of the sphere of World Governments remit is not. It's success would mean anarchy. Not that it could actually succeed as it's so painfully unsuited to handling day-to-day transactions anyway. Moreover, whilst we mostly hear about the winners, coin consumers at present are being boned left right and centre by completely unregulated exchanges. Front-running, wash trading, wildcat banking, pump and dump. It's a complete criminals paradise. The sooner it becomes a harmless piece of digital gold that people can choose to covet or not, the better. |

|

macq

Member of DD Central

Posts: 1,934

Likes: 1,199

|

Post by macq on Jun 7, 2021 12:24:04 GMT

i can understand by using the Latin American countries mentioned in this thread the appeal of keeping money out of the hands of govt. who allegedly may cause inflation/devalue the money,take the money or any other form of misappropriation.

But i am assuming the average person in the countries mentioned (or indeed any country) is not sitting on a pile of money equal to even One Bitcoin. So even if they can own a fraction of a coin today - not knowing if that fraction will buy a loaf of bread,car,house or even nothing in the future does not seem a currency but back to being an investment.

I fail to see how a crypto that is not tied to an exchange rate can help the downtrodden masses throw off the shackles unless they were invested from the start.But what i can see is people who can afford to invest or hodl at the moment(which is fine) including HNW people like Mark Cuban,Elon Musk or the Winklevoss twins among many or hedge funds etc.But i fail to see how this helps a coffee picker in El Salvador but hopefully in time it does?

|

|

james100

Member of DD Central

Posts: 1,084

Likes: 1,287

|

Post by james100 on Jun 7, 2021 13:06:36 GMT

i can understand by using the Latin American countries mentioned in this thread the appeal of keeping money out of the hands of govt. who allegedly may cause inflation/devalue the money,take the money or any other form of misappropriation. But i am assuming the average person in the countries mentioned (or indeed any country) is not sitting on a pile of money equal to even One Bitcoin. So even if they can own a fraction of a coin today - not knowing if that fraction will buy a loaf of bread,car,house or even nothing in the future does not seem a currency but back to being an investment. I fail to see how a crypto that is not tied to an exchange rate can help the downtrodden masses throw off the shackles unless they were invested from the start.But what i can see is people who can afford to invest or hodl at the moment(which is fine) including HNW people like Mark Cuban,Elon Musk or the Winklevoss twins among many or hedge funds etc.But i fail to see how this helps a coffee picker in El Salvador but hopefully in time it does? Absolutely. And the general line of action in a country like that would be to get paid local currency, then either (depending on individual factors eg. whether the government owns the national bank and/or if you are vulnerable to legal/tax clawbacks) a) convert to a stable fiat like USD and keep it banked or b) go out an buy a bit of gold each month and a big fat safe if it doesn't/you aren't. I see much of the story around bitcoin as an idealized and idolized concepts of both libertarianism and socialism which is all very nice. But the reality with respect to volatility and unregulated brokers etc is that it simply does not function as a reasonable currency substitute for the average person yet (in my humble opinion). The current attraction/source of value comes only from lack of transparency and profit speculation (plus curiosity for some, I guess). Also nice, but not 'the dream' being sold by a long shot. The tech tax issue being addressed now has been in discussion for 15 years after everyone knew it was required so I wouldn't like to guess how long this one will take to shake out.

|

|

macq

Member of DD Central

Posts: 1,934

Likes: 1,199

|

Post by macq on Jun 7, 2021 13:27:03 GMT

i can understand by using the Latin American countries mentioned in this thread the appeal of keeping money out of the hands of govt. who allegedly may cause inflation/devalue the money,take the money or any other form of misappropriation. But i am assuming the average person in the countries mentioned (or indeed any country) is not sitting on a pile of money equal to even One Bitcoin. So even if they can own a fraction of a coin today - not knowing if that fraction will buy a loaf of bread,car,house or even nothing in the future does not seem a currency but back to being an investment. I fail to see how a crypto that is not tied to an exchange rate can help the downtrodden masses throw off the shackles unless they were invested from the start.But what i can see is people who can afford to invest or hodl at the moment(which is fine) including HNW people like Mark Cuban,Elon Musk or the Winklevoss twins among many or hedge funds etc.But i fail to see how this helps a coffee picker in El Salvador but hopefully in time it does? Absolutely. And the general line of action in a country like that would be to get paid local currency, then either (depending on individual factors eg. whether the government owns the national bank and/or if you are vulnerable to legal/tax clawbacks) a) convert to a stable fiat like USD and keep it banked or b) go out an buy a bit of gold each month and a big fat safe if it doesn't/you aren't. I see much of the story around bitcoin as an idealized and idolized concepts of both libertarianism and socialism which is all very nice. But the reality with respect to volatility and unregulated brokers etc is that it simply does not function as a reasonable currency substitute for the average person yet (in my humble opinion). The current attraction/source of value comes only from lack of transparency and profit speculation (plus curiosity for some, I guess). Also nice, but not 'the dream' being sold by a long shot. The tech tax issue being addressed now has been in discussion for 15 years after everyone knew it was required so I wouldn't like to guess how long this one will take to shake out. I have nothing against bitcoin & the rest but see them as commodities to be sold at the market value the same as Gold (or even Gold medal 50's paperbacks) art,stamps all the way down to baseball cards,matchbox cars etc But like you i struggle with the ideology - if at the start the price of coins had been fixed in someway so people could use it outside of normal channels then so be it and if it had it would probably been used a lot quicker by business etc. But while other ideas may have been at play in its creation it seems it did not take long to be seen as an investment or collectable and that now seems too ingrained to change it back to a stable currency

|

|

registerme

Member of DD Central

Posts: 6,618

Likes: 6,432

|

Post by registerme on Jun 7, 2021 21:53:31 GMT

|

|

agent69

Member of DD Central

Posts: 6,034

Likes: 4,433

|

Post by agent69 on Jun 17, 2021 16:28:50 GMT

If you're looking for a punt on something different, how about investing in a £400m fusion power plant being built in the UK. The company building the plant is backed by Jeff Bazos and it will be a 70% scale model. Only draw back is it wont produce any power.

As grandad in Only Fools and Horses use to say 'that's gotta be a tempting offer'

|

|

|

|

Post by bracknellboy on Jun 28, 2021 7:29:02 GMT

|

|

adrianc

Member of DD Central

Posts: 9,988

Likes: 5,131

Member is Online

|

Post by adrianc on Jun 28, 2021 7:36:13 GMT

|

|

keitha

Member of DD Central

2024, hopefully the year I get out of P2P

Posts: 4,584

Likes: 2,615

|

Post by keitha on Jun 28, 2021 9:19:58 GMT

If you're looking for a punt on something different, how about investing in a £400m fusion power plant being built in the UK. The company building the plant is backed by Jeff Bazos and it will be a 70% scale model. Only draw back is it wont produce any power.

As grandad in Only Fools and Horses use to say 'that's gotta be a tempting offer'

is Jeff Bazos Jeff Bezos's dodgy cousin

|

|

keitha

Member of DD Central

2024, hopefully the year I get out of P2P

Posts: 4,584

Likes: 2,615

|

Post by keitha on Jun 28, 2021 9:30:14 GMT

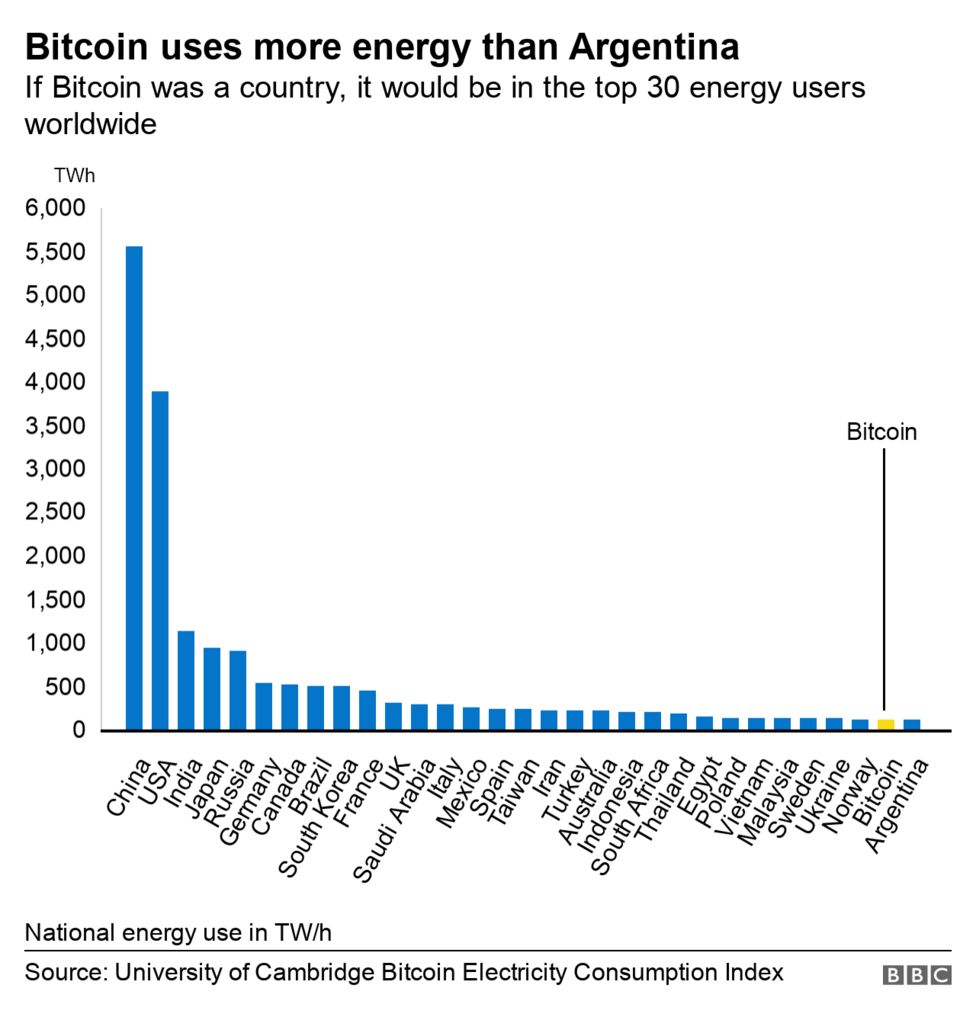

Of course my issue with Crypto and NFT is the processing power being used both mining and to undertake the transactions using blockchain.

anything using the same amount of power annually as Norway can't be good.

|

|

agent69

Member of DD Central

Posts: 6,034

Likes: 4,433

|

Post by agent69 on Jun 28, 2021 9:37:15 GMT

And people say that P2P is the financial wild west.

Although, credit where it's due. The money went walk about when Bitcoin was at its peak. Can't fault timimg like that.

|

|

adrianc

Member of DD Central

Posts: 9,988

Likes: 5,131

Member is Online

|

Post by adrianc on Jun 28, 2021 9:45:04 GMT

Of course my issue with Crypto and NFT is the processing power being used both mining and to undertake the transactions using blockchain. anything using the same amount of power annually as Norway can't be good. Just below Norway, as of February, according to Cambridge University calculations... But it would be one of the top 30 countries worldwide for energy consumption. Above Argentina, NL, and the UAE. www.bbc.co.uk/news/technology-56012952

|

|