|

|

Post by mfaxford on Feb 9, 2021 16:45:23 GMT

Probably reasonable to presume that $1.5Bn purchase wasn't a single transaction and that it was spread across a period of time. Based info from Bloomberg, the average price across Jan 2021 was just shy of $34.7k. Not a bad return if Tesla are already quietly selling.... Almost certainly bought over a period of time unless they wanted to push the price up. I wouldn't be that surprised if they had started last year. I'd imagine EM and Tesla are well aware of what a tweet from EM can do to a market. I also wouldn't be that surprised if they've now planning on selling some bitcoin on the price rises following this news and get a far bit of their capital back.

|

|

lobster

Member of DD Central

Posts: 636

Likes: 467

|

Post by lobster on Feb 10, 2021 14:57:16 GMT

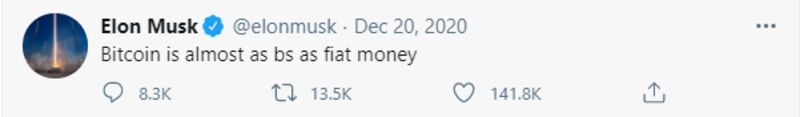

EM makes me laugh... Mid December he tweets:  Then, in January, Tesla goes on a January buying spree.  Probably reasonable to presume that $1.5Bn purchase wasn't a single transaction and that it was spread across a period of time. Based info from Bloomberg, the average price across Jan 2021 was just shy of $34.7k. Not a bad return if Tesla are already quietly selling.... Makes perfect sense : EM decides to buy in December so he fires off tweets like this to push down the price to allow him to buy as cheaply as possible. Now that he has completed his purchases, he's singing the praises of Bitcoin to drive up the price to allow him to sell into strength and make a killing. Got Tesla ?

|

|

r00lish67

Member of DD Central

Posts: 2,692

Likes: 4,048

|

Post by r00lish67 on Apr 19, 2021 10:05:30 GMT

What do people think about crypto at the moment? I've just been watching as an interested observer. I see now that Dogecoin has a market cap of $50bn.

I think at this point, partially because of the Doge situation, I'm leaning towards thinking that this is all going to collapse (again). The thin veneer of respectability/purpose that Bitcoin enthusiasts try to engender is totally undermined by Doge, the coin started as a joke, rapidly catching it up. The bigger joke is that Bitcoin has about the same level of utility as Doge, or at least will when countries that have problematic currencies like Turkey ban it from usage.

It also may follow Turkey's lead in banning crypto transactions, supplanting it with their own respective digital currencies. In a way, its rise is its own downfall. What sensible Government would sit by and allow an unregulated currency to take root?

Aside from those reasons, even if I'm totally wrong about crypto's direction, I sincerely hope the surrounding culture changes. Whatever it's actual merits, what can be said for sure is that crypto currently is a magnet for shills, fraudsters, scams, anti-establishment weirdos and gambling rather than investing. It's like Vegas for investors. You can barely mention money on social media without a bitcoin bro weighing in to diss the fiat currency that is the only useful reference point for how much Bitcoin is 'worth'.

Appreciate the above sounds like sour grapes to some, but I should say well done to those who have either cynically or fanatically made big bucks in the scene. There's certainly money to be made whilst there is so much funny money floating around, which I believe is the only reason why some major institutions are taking note or taking positions in it.

I suspect much of the exuberance is indeed down to all of the stimulus floating about looking for home in a zero yield world - heck, even P2P is seeing renewed interest because of it. I suspect at some point we'll see a dose of inflation, some interest rate rises, and then large inflows back into evil fiat, exposing those who have been for quite some time, swimming naked.

Either that, or perhaps the institutions playing around with crypto themselves will eventually cause some 2008-style leveraged implosion. Wouldn't surprise me. Whilst Bitcoin et al are a cesspit of behaviour, it's not as if major financial institutions don't regularly get their hands dirty when there's money to be made (e.g. Gamestop episode!).

|

|

macq

Member of DD Central

Posts: 1,934

Likes: 1,199

|

Post by macq on Apr 19, 2021 11:06:00 GMT

What do people think about crypto at the moment? I've just been watching as an interested observer. I see now that Dogecoin has a market cap of $50bn. I think at this point, partially because of the Doge situation, I'm leaning towards thinking that this is all going to collapse (again). The thin veneer of respectability/purpose that Bitcoin enthusiasts try to engender is totally undermined by Doge, the coin started as a joke, rapidly catching it up. The bigger joke is that Bitcoin has about the same level of utility as Doge, or at least will when countries that have problematic currencies like Turkey ban it from usage. It also may follow Turkey's lead in banning crypto transactions, supplanting it with their own respective digital currencies. In a way, its rise is its own downfall. What sensible Government would sit by and allow an unregulated currency to take root? Aside from those reasons, even if I'm totally wrong about crypto's direction, I sincerely hope the surrounding culture changes. Whatever it's actual merits, what can be said for sure is that crypto currently is a magnet for shills, fraudsters, scams, anti-establishment weirdos and gambling rather than investing. It's like Vegas for investors. You can barely mention money on social media without a bitcoin bro weighing in to diss the fiat currency that is the only useful reference point for how much Bitcoin is 'worth'. Appreciate the above sounds like sour grapes to some, but I should say well done to those who have either cynically or fanatically made big bucks in the scene. There's certainly money to be made whilst there is so much funny money floating around, which I believe is the only reason why some major institutions are taking note or taking positions in it. I suspect much of the exuberance is indeed down to all of the stimulus floating about looking for home in a zero yield world - heck, even P2P is seeing renewed interest because of it. I suspect at some point we'll see a dose of inflation, some interest rate rises, and then large inflows back into evil fiat, exposing those who have been for quite some time, swimming naked. Either that, or perhaps the institutions playing around with crypto themselves will eventually cause some 2008-style leveraged implosion. Wouldn't surprise me. Whilst Bitcoin et al are a cesspit of behaviour, it's not as if major financial institutions don't regularly get their hands dirty when there's money to be made (e.g. Gamestop episode!). Reports doing the rounds this morning that the Bank of England is setting up a task force to look at the possibility of launching crypto in the future - standby for who can come up with the best name for it but i was thinking Fungible UK Token (ticker code FUKT)

|

|

cb25

Posts: 3,528

Likes: 2,668

|

Post by cb25 on Apr 19, 2021 11:48:47 GMT

What do people think about crypto at the moment? I've just been watching as an interested observer. I see now that Dogecoin has a market cap of $50bn. I think at this point, partially because of the Doge situation, I'm leaning towards thinking that this is all going to collapse (again). The thin veneer of respectability/purpose that Bitcoin enthusiasts try to engender is totally undermined by Doge, the coin started as a joke, rapidly catching it up. The bigger joke is that Bitcoin has about the same level of utility as Doge, or at least will when countries that have problematic currencies like Turkey ban it from usage. It also may follow Turkey's lead in banning crypto transactions, supplanting it with their own respective digital currencies. In a way, its rise is its own downfall. What sensible Government would sit by and allow an unregulated currency to take root? Aside from those reasons, even if I'm totally wrong about crypto's direction, I sincerely hope the surrounding culture changes. Whatever it's actual merits, what can be said for sure is that crypto currently is a magnet for shills, fraudsters, scams, anti-establishment weirdos and gambling rather than investing. It's like Vegas for investors. You can barely mention money on social media without a bitcoin bro weighing in to diss the fiat currency that is the only useful reference point for how much Bitcoin is 'worth'. Appreciate the above sounds like sour grapes to some, but I should say well done to those who have either cynically or fanatically made big bucks in the scene. There's certainly money to be made whilst there is so much funny money floating around, which I believe is the only reason why some major institutions are taking note or taking positions in it. I suspect much of the exuberance is indeed down to all of the stimulus floating about looking for home in a zero yield world - heck, even P2P is seeing renewed interest because of it. I suspect at some point we'll see a dose of inflation, some interest rate rises, and then large inflows back into evil fiat, exposing those who have been for quite some time, swimming naked. Either that, or perhaps the institutions playing around with crypto themselves will eventually cause some 2008-style leveraged implosion. Wouldn't surprise me. Whilst Bitcoin et al are a cesspit of behaviour, it's not as if major financial institutions don't regularly get their hands dirty when there's money to be made (e.g. Gamestop episode!). Reports doing the rounds this morning that the Bank of England is setting up a task force to look at the possibility of launching crypto in the future - standby for who can come up with the best name for it but i was thinking Fungible UK Token (ticker code FUKT) What would be the point of a state-backed cryptocurrency?

Taking Bitcoin as an example of a current cryptocurrency:

-those who like Bitcoin because they hope it's out of view of law/tax authorities won't be happy as state offerings would most likely be trackable

-those who like Bitcoin for the volatility that enables gambling won't be happy as I'd guess state cryptocurrencies would have to be stable to get mass uptake

|

|

macq

Member of DD Central

Posts: 1,934

Likes: 1,199

|

Post by macq on Apr 19, 2021 11:55:54 GMT

Reports doing the rounds this morning that the Bank of England is setting up a task force to look at the possibility of launching crypto in the future - standby for who can come up with the best name for it but i was thinking Fungible UK Token (ticker code FUKT) What would be the point of a state-backed cryptocurrency?

Taking Bitcoin as an example of a current cryptocurrency:

-those who like Bitcoin because they hope it's out of view of law/tax authorities won't be happy as state offerings would most likely be trackable

-those who like Bitcoin for the volatility that enables gambling won't be happy as I'd guess state cryptocurrencies would have to be stable to get mass uptake

Guess its a fear of missing out or a case of being in control - but there was a reason i picked my ticker code

|

|

IFISAcava

Member of DD Central

Posts: 3,692

Likes: 3,018

|

Post by IFISAcava on Apr 19, 2021 11:58:52 GMT

What do people think about crypto at the moment? I've just been watching as an interested observer. I see now that Dogecoin has a market cap of $50bn. I think at this point, partially because of the Doge situation, I'm leaning towards thinking that this is all going to collapse (again). The thin veneer of respectability/purpose that Bitcoin enthusiasts try to engender is totally undermined by Doge, the coin started as a joke, rapidly catching it up. The bigger joke is that Bitcoin has about the same level of utility as Doge, or at least will when countries that have problematic currencies like Turkey ban it from usage. It also may follow Turkey's lead in banning crypto transactions, supplanting it with their own respective digital currencies. In a way, its rise is its own downfall. What sensible Government would sit by and allow an unregulated currency to take root? Aside from those reasons, even if I'm totally wrong about crypto's direction, I sincerely hope the surrounding culture changes. Whatever it's actual merits, what can be said for sure is that crypto currently is a magnet for shills, fraudsters, scams, anti-establishment weirdos and gambling rather than investing. It's like Vegas for investors. You can barely mention money on social media without a bitcoin bro weighing in to diss the fiat currency that is the only useful reference point for how much Bitcoin is 'worth'. Appreciate the above sounds like sour grapes to some, but I should say well done to those who have either cynically or fanatically made big bucks in the scene. There's certainly money to be made whilst there is so much funny money floating around, which I believe is the only reason why some major institutions are taking note or taking positions in it. I suspect much of the exuberance is indeed down to all of the stimulus floating about looking for home in a zero yield world - heck, even P2P is seeing renewed interest because of it. I suspect at some point we'll see a dose of inflation, some interest rate rises, and then large inflows back into evil fiat, exposing those who have been for quite some time, swimming naked. Either that, or perhaps the institutions playing around with crypto themselves will eventually cause some 2008-style leveraged implosion. Wouldn't surprise me. Whilst Bitcoin et al are a cesspit of behaviour, it's not as if major financial institutions don't regularly get their hands dirty when there's money to be made (e.g. Gamestop episode!). I thought long and hard, and eventually dipped a toe in with the aim of having about 0.5% of my portfolio in it (and a 1% absolute cap). It was mainly a currency hedge. I've top sliced on the way up so that I have now regained all the initial outlay. It's been a way to while away the time in lockdown and I have paper profits of a middling 5 figure sum. What I don't know (obviously) is when to cut and run. I am starting to sell off a bit more, as my cap is being breached, and I think there are huge tulips around (DOGE shaped tulips). But it kind of adds diversity to the portfolio, avoids too much FOMO, and if it lost 90%+ of its value (quite possible) I won't suffer that much.

|

|

|

|

Post by mfaxford on Apr 19, 2021 12:04:11 GMT

What do people think about crypto at the moment? I've just been watching as an interested observer. I see now that Dogecoin has a market cap of $50bn. ... It also may follow Turkey's lead in banning crypto transactions, supplanting it with their own respective digital currencies. In a way, its rise is its own downfall. What sensible Government would sit by and allow an unregulated currency to take root? Aside from those reasons, even if I'm totally wrong about crypto's direction, I sincerely hope the surrounding culture changes. Whatever it's actual merits, what can be said for sure is that crypto currently is a magnet for shills, fraudsters, scams, anti-establishment weirdos and gambling rather than investing. It's like Vegas for investors. You can barely mention money on social media without a bitcoin bro weighing in to diss the fiat currency that is the only useful reference point for how much Bitcoin is 'worth'. I'm not sure banning it would achieve much and I think most governments recognise that (I did see a comment from someone within the US SEC suggesting banning bitcoin is like shutting down the internet). I think regulation is more likely which at least means it's clear how bitcoin and others can be used and what information has to be provided. That in turn might make it harder for the shills, scams and general misunderstanding to continue at the level they currently are. Related I saw this comment posted earlier. Which shows some of the general ignorance (or gullibility) with some people investing in cryptos. I pointed out that whilst it might technically be correct it's also meaningless/misleading as it's the buying power and/or stability of the currency that matters most. Separately there was a large drop in bitcoins price yesterday although some of that then recovered.

|

|

mrdc

Member of DD Central

Posts: 73

Likes: 33

|

Post by mrdc on Apr 19, 2021 12:34:51 GMT

I put £150 on Binance 11/12/20. Messed about trading 6 different coins. Withdrew £163.85 on 15/01/21. During that short time i received a free airdrop of 100 TWT and ive just looked and they are valued at £50.72. No its not for me at my age. If i can keep my pot slightly ahead of inflation it should see me to my grave  |

|

|

|

Post by mfaxford on Apr 19, 2021 13:23:04 GMT

What would be the point of a state-backed cryptocurrency?

Taking Bitcoin as an example of a current cryptocurrency:

-those who like Bitcoin because they hope it's out of view of law/tax authorities won't be happy as state offerings would most likely be trackable

-those who like Bitcoin for the volatility that enables gambling won't be happy as I'd guess state cryptocurrencies would have to be stable to get mass uptake

I suspect there's a lot of mixing of terms. I think in many cases people/media/spokespeople say cryptocurrency/bitcoin when they really mean blockchain. What I suspect banks, governments etc like is blockchain technology as it gives you an equivalent of recording the serial numbers of every bank note each time it changes hands. Just imagine how much they'd like it if they could see that the £50 you just deposited at HSBC was withdrawn from the Barclays down the road (possibly a good or bad thing depending on whether you want to hide the source of your money or not). The currency aspect (bitcoin and others) is something that sits on top of the cryptographically generated blockchain but I've also seen suggestions of using blockchain to track other assets (food items from production through to consumption), energy trading, healthcare data etc.

|

|

|

|

Post by Deleted on Apr 19, 2021 13:30:24 GMT

A sarcasm emoji does not do it justice

|

|

r00lish67

Member of DD Central

Posts: 2,692

Likes: 4,048

|

Post by r00lish67 on Apr 19, 2021 14:00:54 GMT

I think the reason for my post today is actually summed up by this timely post (I really recommend Nick Maggiulli's blog in general btw). It's more than just a dig at crypto, it's the general unhinging of investing from any sort of fundamentals in the market at the moment. I mean, investing is never strictly only about that of course, but this is something else. As he points out " Currently, we have an antiquated video game retailer (GME) being valued at $10 billion (nearly 10 times what it was worth at the start of the year). We have a literal joke internet coin (Dogecoin) that has a market cap of over $50 billion. And I just recently heard about a single deli in New Jersey (HWIN) that was recently valued at over $100 million. The deli had $35,000 in sales over the previous two years"

We are living in a world where the best joke makes the best investment. It's just so bizarre. The consolation I take for not being one of those able to take such risks with any meaningful amount of money, is that if you have the *diamond hands* to hold onto a doggy joke investment all the way until you're a millionaire, then you're probably also insane enough to hold it all the way down too, or mistakenly diversify into the less successful catty coin  edit: oh and, this: |

|

hazellend

Member of DD Central

Posts: 2,363

Likes: 2,180

|

Post by hazellend on Apr 19, 2021 20:11:15 GMT

it's the general unhinging of investing from any sort of fundamentals in the market at the moment.

Yup.

The US markets in particular are terribly unhealthy.

The US markets are suffering from a vicious circle of herd-thinking.

People piling into the fashionable FAANG stocks.

People then piling into passive US trackers which contain FAANG.

This adds to the upwards pressure on a concentrated number of stocks.

You end up with skewed market pricing which is based on herd buying of individual equities and ETF trackers.

You also end up with a skewed perception of the indices too, they are being dragged up by a concentrated few rather than reflecting reality.

And that's before we start talking about the Robin Hood brigade.

Should be easy for active managers to beat the market just by snorting FAANG.

|

|

dead-money

Rocket to the Moon

Posts: 746

Likes: 654

|

Post by dead-money on Apr 20, 2021 7:37:12 GMT

Yup.

The US markets in particular are terribly unhealthy.

The US markets are suffering from a vicious circle of herd-thinking.

People piling into the fashionable FAANG stocks.

People then piling into passive US trackers which contain FAANG.

This adds to the upwards pressure on a concentrated number of stocks.

You end up with skewed market pricing which is based on herd buying of individual equities and ETF trackers.

You also end up with a skewed perception of the indices too, they are being dragged up by a concentrated few rather than reflecting reality.

And that's before we start talking about the Robin Hood brigade.

Should be easy for active managers to beat the market just by snorting FAANG.

Yep, Baille Gilford, Polar Capital and any another Technology Investment Trust!

Plus buying a bit of Tesla; although isn't that now a Bitcoin proxy, rather than a Tech or Automotive company?

|

|

|

|

Post by mfaxford on Apr 20, 2021 10:18:08 GMT

Sure blockchain is cool and all that. But it doesn't mean all the technology that went before is suddenly obsolete and its "blockchain or nothing". I'd definitely agree with you there. I can see potential for it solving some interesting problems (healthcare records possibly being one) but it needs the backing of people with the unusual ideas (can we put private records securely on a public blockchain) along with those with the ability to also see the risks (could data be compromised, will it be useable in practice). But then that's a common thing in technology. A favourite game where I was working 15 years ago was to ask technology sales people what they meant by the cloud. You could ask 10 different sales reps and get at least 20 different answers (and probably still can).

|

|