|

|

Post by oldnick on Jan 29, 2014 19:08:28 GMT

In light of the fact that the current historically low bank rates are widely expected to return to average levels sooner or later, does that imply that we should be cautious about commiting significant money to five year loans? A lot can happen to our economy during the lifetime of a five year loan so perhaps we should be thinking about shorter loan periods, allowing us the chance to relend at a higher rate in line with the prevailing market rate.

Granted it wouldn't be appreciated by those businesses hoping to lock in to a stable interest rate in the medium term, but perhaps then there needs to be more of a premium added to longer loans to cover us for the risk to our capital if rates and inflation do take off?

I'd be interested to hear the views of P2P/B representatives on the forum about this, and also whether they are already building into current rates a factor allowing for future interest changes. (Or is that too commercially sensitive?)

|

|

|

|

Post by bracknellboy on Jan 29, 2014 20:57:07 GMT

I shouldn't worry about that: its quite likely that a sufficiently large %age of them won't manage to last for the full 5 years as to render the subject hypothetical

|

|

|

|

Post by yorkshireman on Jan 30, 2014 23:34:46 GMT

In light of the fact that the current historically low bank rates are widely expected to return to average levels sooner or later, does that imply that we should be cautious about commiting significant money to five year loans? A lot can happen to our economy during the lifetime of a five year loan so perhaps we should be thinking about shorter loan periods, allowing us the chance to relend at a higher rate in line with the prevailing market rate. Granted it wouldn't be appreciated by those businesses hoping to lock in to a stable interest rate in the medium term, but perhaps then there needs to be more of a premium added to longer loans to cover us for the risk to our capital if rates and inflation do take off? I'd be interested to hear the views of P2P/B representatives on the forum about this, and also whether they are already building into current rates a factor allowing for future interest changes. (Or is that too commercially sensitive?) Yes, I think caution should be the watchword generally but especially, and this is not a criticism, with 5 year rates of 5.7 /5.8% as currently offered on Ratesetter.

I still hold 3 year loans which are under 2.5 years old with Ratesetter at rates in excess of 7.0% compared to the 4.4 / 4.5% currently available.

If rates can fall by 2.5 percentage points in not much more than 2 years I take the view that they could rise by that amount over a similar period which if applied to 5 year loans could mean that we would be looking at rates in the region of 8%.

|

|

pikestaff

Member of DD Central

Posts: 2,187

Likes: 1,546

|

Post by pikestaff on Jan 31, 2014 7:55:39 GMT

My view is general interest rates will rise slowly and not to pre-recession levels.

I see p2p rates as being pretty static because it is still an immature market and I expect the spread between p2p rates and general rates to fall, except in those markets where p2p rates are already too low.

|

|

|

|

Post by batchoy on Jan 31, 2014 9:47:09 GMT

My view is general interest rates will rise slowly and not to pre-recession levels. I see p2p rates as being pretty static because it is still an immature market and I expect the spread between p2p rates and general rates to fall, except in those markets where p2p rates are already too low. I broadly agree with you, but the one potential issue on the horizon is the housing market which could cause problems. I just which successive governments would just stop meddling and let the housing market crash properly, but its never going to happen as it would be electoral suicide.

|

|

|

|

Post by oldnick on Jan 31, 2014 9:53:00 GMT

[/quote] Yes, I think caution should be the watchword generally but especially, and this is not a criticism, with 5 year rates of 5.7 /5.8% as currently offered on Ratesetter.

I still hold 3 year loans which are under 2.5 years old with Ratesetter at rates in excess of 7.0% compared to the 4.4 / 4.5% currently available.

If rates can fall by 2.5 percentage points in not much more than 2 years I take the view that they could rise by that amount over a similar period which if applied to 5 year loans could mean that we would be looking at rates in the region of 8%.

[/quote] I'm old enough to remember the inflation of the 70's. Borrowing money was a canny thing to do as you could invest it in bricks and mortar and watch your wealth increase and your debt shrink in real terms. Great for borrowers - lousy for lenders!

|

|

bugs4me

Member of DD Central

Posts: 1,845

Likes: 1,478

|

Post by bugs4me on Jan 31, 2014 9:58:10 GMT

My view is general interest rates will rise slowly and not to pre-recession levels. I see p2p rates as being pretty static because it is still an immature market and I expect the spread between p2p rates and general rates to fall, except in those markets where p2p rates are already too low. I broadly agree with you, but the one potential issue on the horizon is the housing market which could cause problems. I just which successive governments would just stop meddling and let the housing market crash properly, but its never going to happen as it would be electoral suicide. Can't see a housing market crash in the UK as you correctly point out it would be electoral suicide. The market may plateau or dip slightly but we're not in for anything like a USA crash in certain cities over there. Have to go with pikestaff about interest rates - they will probably rise but only slowly.

|

|

jimbo

Posts: 234

Likes: 42

|

Post by jimbo on Jan 31, 2014 11:25:25 GMT

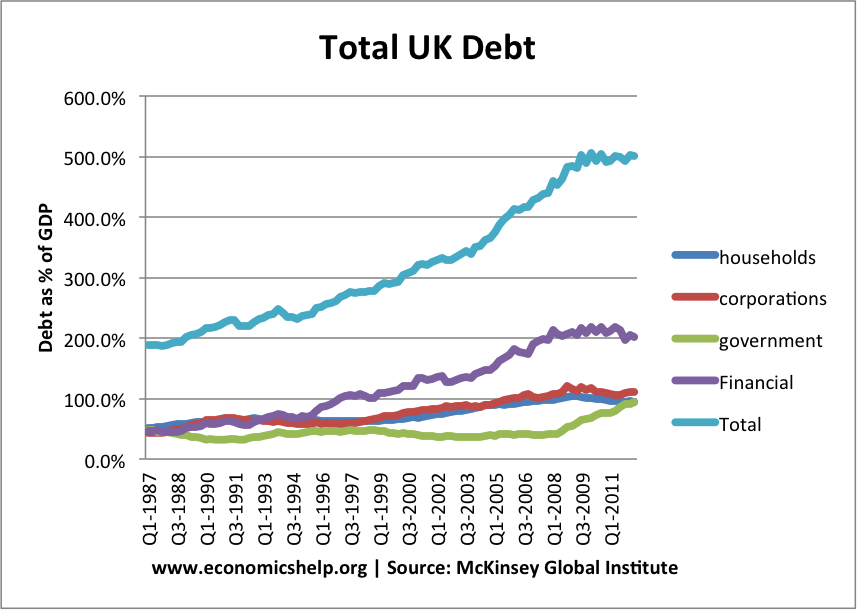

We're not in the short term, but the medium - longer term could be a very different picture. Our National Debt:GDP is already at dangerous levels. See:  The bang moment (at which point bond markets stop funding our borrowing binge) will likely be somewhere between 120 - 130% Government Debt:GDP. At that point, gilt prices will fall, meaning yields will rise, meaning the Bank of England base rate will rise - probably very dramatically. At such a point, we would probably see the Pound take an enormous hit on the Forex Markets and our housing market crash - a bit like Spain's has done (some -70% peak to trough I believe). The 2008 fallout will continue to impact us for some time. We are approaching the closing stages of a credit bubble that has been some 35 years in the making (ironically, most of my lifetime). Here's a chart showing the growth of that bubble in the US:  The UK is participating in the very same credit bubble. The sub-prime debacle of 2008 marked the beginning of the end. We are currently somewhere in the middle of the beginning... Incidentally, for anybody looking at the above chart, have a guess at approximately when it was the US finally abandoned the Gold Standard (40% backing to the USD at the time). |

|

|

|

Post by davee39 on Jan 31, 2014 13:49:00 GMT

Might QE start to unwind before official rates rise?

The US is only reducing the ADDITIONAL stimulus put into the market yet world markets have posted a displeased reaction

Since QE was intended to lower interest rates over and above the low bank rate, then tearing up some of the funny money might lead to rises in financial markets.

Overall the QE backlog and huge overhanging debs make any significant rises unlikely. I predict a 1% rate at the end of 2015.

Since 5yr loans from the 3 largest P2P providers repay capital as well as interest the outstanding loans will have reduced before any rate rise might make returns look less attractive.

|

|

jimbo

Posts: 234

Likes: 42

|

Post by jimbo on Jan 31, 2014 15:15:14 GMT

I'm of the view that our American cousins at the Fed will continue to taper their QE program. However, given it's been supporting their bond market by suppressing the yield available on long dated US treasuries (The Federal Reserve owned just over 30% of the longer-dated bonds as of last October. See here) and that all other financial markets are being priced off this suppressed level of risk (rising stock markets anybody), at some point when they taper, T-Bond yields will start rising (as they did last May when taper talk first surfaced). Given the size of the US National Debt as a percentage of GDP, this will have to worry them. Additionally, rising bond yields are bad for stock markets (debt becomes more expensive, along with servicing it), so I'd expect a negative reaction from the S&P 500. Rising bond yields will also hit US mortgage rates, which will choke off their housing recovery. I suspect the Fed will end up being forced by the markets to reduce or even begin back-tracking on the taper, as any tailspin in the S&P 500 will threaten the aura of omnipotence they have managed to cultivate for themselves since 2009. Any backtracking will likely reduce their credibility in the eyes of institutional bond market investors, and once this reaches a critical mass, the Fed will be forced to 'un-taper' even more in order to try to keep a lid on treasury yields (important to understand that interest rate risk in all credit securities is ultimately priced off your sovereign bond market). At some point, if they keep going down this road of printing money to purchase treasuries against an ever increasing backdrop of out of control Government spending and spiralling sovereign debt, they will end up destroying the USD as a currency. At what point, and what percentage holding of your sovereign debt does the situation become farcical...? At the end of the day, the USD remains the World's reserve currency for the time being, so I suspect if this sorry outcome happens to the US, it will happen to them last. I have no doubt it is more likely to happen to the UK first. It's important to understand that when central bankers like Mike Carney speak, they are trying to manage perceptions of the actions they are taking and will take in the future. It's important to follow what they actually do, rather than what they say. In a nutshell then, my own opinion (for what it's worth) is that interest rates will remain low for the next couple of years. However, at the point where QE begins to lose its ability to suppress sovereign bond yields, they will correct upwards; maybe gradually at first, but eventually the move could be quite violent. Imagine what base rates in the order of 10%+ would do to the UK housing market. It would not be pretty... |

|

|

|

Post by batchoy on Jan 31, 2014 20:59:58 GMT

Imagine what base rates in the order of 10%+ would do to the UK housing market. It would not be pretty... I don't have to imagine I can remember to happened to colleagues in 88-91 and at that time they had been taking on mortgages of 3 to 3.5 time their salary when the base rate was not 8% to 9% not 0.5%

|

|

|

|

Post by bracknellboy on Jan 31, 2014 21:33:49 GMT

Imagine what base rates in the order of 10%+ would do to the UK housing market. It would not be pretty... I don't have to imagine I can remember to happened to colleagues in 88-91 and at that time they had been taking on mortgages of 3 to 3.5 time their salary when the base rate was not 8% to 9% not 0.5% Indeed. I'm of a generation that my peers got caught in the "ending of MIRAS" trap: what a b****y stupid issue that was. Announce the ending of MIRAS, but give it 12 (or was it longer) months to run: upshot was that house prices increased even further as people sought to buy before hand; I knew colleagues who partnered up with another work colleague in order to afford to jointly buy a place and secure the (was it £60k combined) MIRAS relief. And then came the downturn and -ve equity. Thankfully I kept out. I think I picked up my place in either late 91 or 92: not entirely sure, but missed the real value peak by a decent enought margin. Meanwhile I knew a load of people a) trapped in -ve equity b) co-owner either someone they no longer wanted to, or had different plans and therefore different opinions on selling etc.

|

|

|

|

Post by uncletone on Jan 31, 2014 22:49:43 GMT

I am extremely grateful that I bought my current house 38 years ago! Call me a stick-in-the-mud. I recently bought a car for £45 more than I paid for this house....  |

|

|

|

Post by batchoy on Feb 1, 2014 7:29:46 GMT

In some ways the late '80s crash actually worked in my favour, at the time I was in a joint equity property built by the local authority. The properties were meant to be outside the right to buy scheme as they were not technically council housing and not maintained by the council however after the 'nominal' rent on the half we didn't own reached the as much as was being paid on mortgages and it was discovered that the council had used the same rent increase formula for us as their regular properties a residents association was formed. Under threat of legal action from the residents the local authority was given the option of either significantly reducing the rent and giving us rebates or including the properties in the right to buy scheme and they chose the latter. The fall in property prices and the right to buy discount on the half I didn't own meant that overnight I went from -ve equity to +ve equity, owned me house outright and the savings in ground rent were more than the increase in my mortgage so I had money in my pocket.

|

|

|

|

Post by oldnick on Feb 1, 2014 7:44:50 GMT

I am extremely grateful that I bought my current house 38 years ago! Call me a stick-in-the-mud. I recently bought a car for £45 more than I paid for this house....  STICK IN THE MUD! You asked for it.

|

|